If any economy is growing, it needs fuel for that growth, just like it needs steel and Cement for infrastructure.

There are two different segments in the Oil sector. One is upstream, and another is downstream. Upstream is mainly searching for the right place where oil is under the earth’s crust and whether it is economically viable to drill or dig. However, it also includes a refinery, which provides for processing and making products that are possible to sell, which are sold from Downstream Companies.

OPEC is an international body of Oil producers which holds a significant stake in oil production.

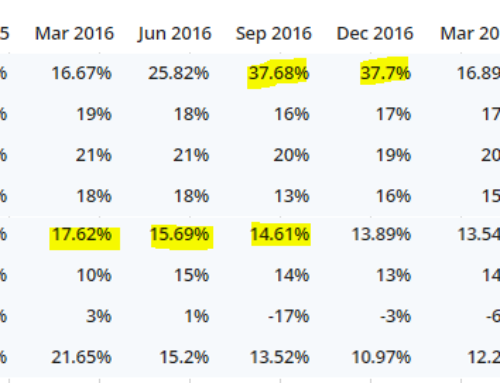

India’s oil demand is expected to grow at a CAGR of 3.6 percent to 458 Million Tonnes of Oil Equivalent (MTOE) by 2040, while energy demand will more than double by 2040 as the economy will grow to more than five times its current size, as stated by Mr. Dharmendra Pradhan, Minister of State for Petroleum and Natural Gas. Gas production will likely touch 90 Billion Cubic Metres (BCM) by 2040, subject to the current formula that determines the price paid to domestic producers, while demand for natural gas will grow at a CAGR of 4.6 percent to touch 149 MTOE. India is the fourth-largest Liquefied Natural Gas (LNG) importer after Japan, South Korea, and China, accounting for 5.8 percent of the total global trade. Domestic LNG demand is expected to grow at a CAGR of 16.89 percent to 306.54 MMSCMD by 2021 from 64 MMSCMD in 2015. Investments in India’s oil and gas sector will likely touch Rs 2.5-3 trillion (US$ 37.28-44.73 billion) over the next few years, which will help raise the share of gas in the country’s primary energy mix to 15 percent by 2030, as per British multinational oil and gas company BP Group. State-owned Oil and Natural Gas Corporation (ONGC) dominates the upstream segment (exploration and production), producing around 22.37 MT of crude oil, approximately 60.5 percent of the country’s 36.95 MT oil output, as of March 2016. It has launched a start-up fund of Rs 100 crore (US$ 14.91 million) in its Diamond Jubilee year to encourage and promote new ideas related to the oil and gas sector, thereby giving a fillip to Government’s Startup India initiatives. ONGC Videsh Ltd (OVL), the foreign arm of state-owned petroleum explorer Oil and Natural Gas Corporation (ONGC), has planned to acquire up to 15 percent stake in CSJC Vankorneft, which owns Russia’s second-largest oil and gas field. (from If)

The govt is also taking steps to make India self-sufficient in energy.

The Ministry of Petroleum and Natural Gas is seeking to enhance India’s crude oil refining capacity through 2040 by setting up a high-level panel, which will align India’s energy portfolio with changing trends and transition towards cleaner energy generation sources. In addition, the Ministry of New and Renewable Energy (MNRE) plans to launch an integrated bioenergy mission with an investment of Rs 10,000 crore (US$ 1.49 billion) from FY 2017-18 to FY 2021-22, aimed at enhancing the use of biofuels like ethanol and biogas and reducing consumption of fossil fuels. As State-Run companies dominate the sector, the decision of ONGC and Oil India is essential. The Union Cabinet has allowed state-owned oil firms to evolve their crude oil import policies, which involve freedom to choose source companies and pricing for their crude oil imports, thus allowing them to compete in the market effectively.