Poll on how do you invest in Mutual Funds

Pls Vote ur choices & RT

— Nagpal Manoj (@NagpalManoj) March 3, 2017

Many investors are going through the DIRECT way. But are all of them aware of bits and parts of it? I am sure that at least 200 mutual Fund schemes are available in India. But all of them are not right. Some may make losses, and Some may be there for a long time, like the EKG of ROCK.

So the question is how to choose Mutual Funds or ETFs?

First of all, there is some difference between ETFs and Mutual Funds. The most basic ETFs are traded on Exchanges only. On the other hand, the mutual fund may or may not Trade in Exchange.

Let’s Check all the Aspects.

- What do you need? Portfolio theory explains that single stock is risky, but with the whole portfolio, That one stock is maybe less risky. What is your current asset allocation? What you need is more critical. Sometimes, the Risk-Reward ratio AKA the Sharpe ratio, may not be attractive to you. Maybe your risk appetite is different for such Mutual Fund or ETF.

- Same Question in Different aspect, What you need and what suit’s you? There are different types of Mutual Funds. Debt fund, Equity Fund, Sectoral Fund, Hybrid Fund, Balanced Fund, Money Market Fund, G-Sec, ELSS, International Fund, Close Ended Open-Ended, Growth Fund, Dividend Fund, Index Fund… Maybe more Four or Five. Everyone is different. Which type do you need that is suitable for your portfolio. It depends upon the next factor.

- Mutual Fund is a portfolio Developed by a Professional For keeping specific Objectives in mind. When you are adding them to your portfolio, you are accessing one Readymade portfolio into your portfolio. What is the effect? Is that’s same as what you expected? Do you have a sufficient risk appetite? Many people invest in Mutual funds and forget them. Though I am not an expert in the field, My personal view is to check the performance of the market and the scheme. Sometimes there may be a low performance for a short time, but that’s OK. But if it is keeping that same then think to change.

- Rush for Multi bagger. I want to mention it. As of today, HDFC Equity is India’s Largest Mutual Fund, with an AUM of more than ₹ 16k cr. More than $ 2.4 bn. Quite Big. But it was the worst performer in its first one or two years. I have lost little money. So how much is the right time to be invested in Mutual Funds? It depends on which type of mutual fund you invest in.

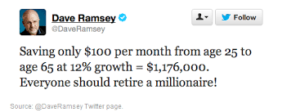

- Many people will tell you many things about Mutual Funds. Some may say that Active Mutual funs are not good. Some may advise Active mutual fund by telling you, Dave Ramsay and Peter Lynch. Many people forget that if you assume Berkshire Hathaway is a mutual fund, Warren Buffett is also an Active Investor. He is not following any index.

- Rush for Zero load Fund is not Right. But that does not mean you ignore Costs. The expense ratio can make or break the whole portfolio. But as you can see, Sectoral Funds always have a High Expense ratio. In my opinion, If it is making an extra return, it is acceptable to pay extra. Cost.

- My view is to add a Sectoral fund into the portfolio only if you are working in the same fields. So, for example, if you are an oil company or energy company employee, then add that sector. The reason is many of them are cyclical. So keeping a tap on them is difficult. But investing and selling at the right time will make Good wealth.

- Nowadays, there is excessive marketing about SIP, a Systematic Investment Plan. It is an excellent idea to keep such a plan. I believe that sometimes Investing in a Lump sum is also not bad. That does not mean I am against SIP. It is a great way to invest, making it easy to sponsor you in a small portion.

- You may find some people who will tell you that BUY and HOLD is an excellent strategy. Some may give you opposite advice like Don’t fall in love with your stock. My view is BOTH are Correct. Excessive of anyone is terrible.

- Last but not least. Don’t invest in any stock which is difficult to understand for you. For me, Steel and Infra are talking like Greek. But banks and financial companies are good for me.

Many people think that A mutual fund is a right way to diversify investment. They can add so many funds without even giving it any thought. The last time I listened, One investor invested in 40+ schemes.

Just received an SOS from a DIY senior citizen investor. Doesn't know which of 90 odd folios have unclaimed dividend!!

Yes 90 folios!!— Mahesh 🇮🇳 (@invest_mutual) September 26, 2016

Why? No answers. Something similar

Common Stocks a/c DSP Microcap and DSP Small & MidCap

Almost 40%-45% overlap of portfolio though investment mandate is different

Go figure! pic.twitter.com/FwxPdS0sAg— Nagpal Manoj (@NagpalManoj) February 20, 2017

Keeping Cash in hand is a perfect strategy, but not always. I wouldn’t say I like any fund holding cash of more than 2% for the long term. But, if they are saving Cash, why go to Mutual Fund?

ICICI MF increases cash levels to a high of 12%+ due to auto investment mandate

How much cash does your MF hold? pic.twitter.com/HEjFrkWSN6— Nagpal Manoj (@NagpalManoj) February 17, 2017

Case For Investing In International or Global Fund

There is No Problem with investing in Global Mutual Funds. It is a far better option to invest offshore than direct equity. But there is something which you need to understand.

When you invest offshore, the whole scale is changing. India, the US, Canada, Japan, Mexico, China, EU, Brazil, Russia, and South Africa are different. When you are investing from one to another, it is not only Forex but many more. However, Forex risk is a big part of it. I do not deny that. If you are sure to make a return to cover that extra Risk, then only invest in Direct equity foreign.

Does the Size of a Mutual Fund matter?

As of this writing, there are 10 Mutual Fund schemes in India with Assets Under Management of ₹10k cr. Sufficient Large. Many times, Investors asked whether to invest in such a scheme or not. Out of that 10, 2 are defiantly Performing Better in the Group. Historically, there are many examples by which it is proven that Even more large mutual funds outperformed Indices.