What is Buyback?

Buyback, also known as repurchase, is the purchase by a company of its outstanding shares that reduces the number of shares in the open market.

Why do investors invest in stock? Because they believe that stock is undervalued. So by investing in stock, investors are trying to earn a return. So why do Companies want to buy back their stock, or do some companies want to invest in themselves? The simple reason is that they believe that the stock price does not represent their financial strength.

Interestingly, Peter Lynch, in his book One up on Wall Street, mentions the difficulty in understanding the point of view excitingly.

Exxon has been buying in shares because its cheaper than drilling for oil. it might cost Exxon $6 a barrel to find new oil, but if each of its shares represents $3 a barrel in oil assets then retiring shares has the same effect as discovering $3 oil on the floor of the New York Stock Exchange. – Peter lynch in One Upon Wall Street.

In his book, Peter Lynch also mentioned four alternatives for the buyback. 1. Raising the dividend. 2. Developing a new product. 3. Starting new operations 4, making acquisitions. By giving an example of Gillette, He mentioned how the final three are nothing but breaking business.

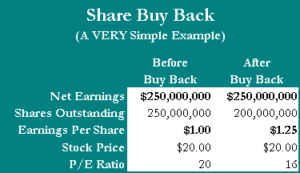

A buyback allows companies to invest in themselves. In buybacks, the shares are repurchased by the company and are shown in the financial statements as treasury stock. It can be sold later if the company decides so. By reducing the number of shares outstanding on the market, buybacks increase the proportion of shares owned by enduring investors. This is because a company may feel its shares are undervalued and repurchase them to provide investors with a return and because it is bullish on its current operations.

A company can fund its buyback by taking on debt, with cash on hand or with its cash flow from operations.

Though in India, We removed them from the balance sheet. If the company wants to increase its capital, they need to take permission. When a company accumulates surplus cash, has no alternative investment opportunities, or is not looking at any acquisition, it can go for a buyback of its shares. Having a large part of the balance sheet as cash is not a good sign for the company. This reduces the capital base and raises earnings per share and Return on Equity.

Buybacks send a positive signal to the markets as the promoters and management believe the share is undervalued and the company doesn’t need cash to cover future commitments such as interest payments and capital expenditures.

This is what theory says about buyback, so the question is…

Should You sell stock in buyback?

The first question here to ask yourself is What is the reason behind it? De-listing? To increase promoter shareholding? To Through away some Outsiders trying to buy a controlling stake? Or to return excess cash to shareholders, Boost Ratio, Recapitalization of some private equity investors, Mphasis, or Tata sons.

There is some business where the cash generation is far more than the need of it. Business like where R&D is very low, the Whole business is boring, like Oil and Gas.

If the company is De-listing, you don’t have any other choice. Yes, there is a different market for such stocks, but it’s difficult for such stocks to find buyers. So the best option is to sell.

Here I want to mention Essar oil. Though the company was De-listing, it was not the company that was buying. It was the promoter. It was taking place in some unique situation. You may choose to hold if that is not a significant amount, like a few stocks in your portfolio.

But if the company is buying back for some different reason. Like what reliance did in 2012. Valued Rs 10440 cr, one of the most significant buybacks and still through Open Market Operation. Another Recent example is Bharat Electronics Limited. If you checked it, you would realize that ROE crosses 15% after the buyback, which is one of the critical fundamental reasons for investors. In such cases, you have two choices. One hold. Though in cases like Reliance, it is impossible to say anything. But in a case like BEL, there is a choice to sell one part and hold another position.

If it’s for preventing the outsiders from taking a controlling stake, As per CFA Institute, It’s not good. What is wrong if someone understands your company’s undervalued stock and tries to make it right by rewarding shareholders? That is what Activist Investors do. If that is the case, sell the stock, the company is not in the right hand, the management is not performing their duties, and they also don’t want to leave.

Returning excess cash to shareholders is nothing wrong. But here, I want to mention the current situation in the Indian IT industry. In fact, why Indian many other companies doing this. When your business is in such a situation, it will not change significantly even if you start investing in the industry. Still, if the company keeps generating cash, it’s better to make a buyback and raise dividends.

If the company is trying to keep stock in a firm hand by buying back stock from investors who don’t have faith in the business, then it’s very positive. But ignore it and start buying stock f you believe the business is good. How to identify? The company is operating in an industry with a difficult situation, but there is some sign of revival. That will even boost the ratio also as it will reduce dividend liability in the future and concentrate ROE also.

The last type, Which is not generally practiced in India but maybe in the US, is used. When there is one private equity investor, you need to give them a return within a specific time. If the company failed to generate such a return in that time frame but held cash on the balance sheet, it’s better to make a buyback. So Private Equity investors will receive some money and be free to invest it. Recently TCS came up with such a type of offer. If you are a retail investor, it is up to you what you want. Generally, this type needs to analyze such an offer thoroughly.

Another reason for a buyback is for compensation purposes. For example, companies often award their employees and management with stock rewards and stock options; to make due on the shares and votes, companies buy back shares and issue them to employees and management.