Global warming and Environment are significant concerns all over the world. We are seeing many big industries taking initiatives to keep it low. Burning fossil fuel is one big reason for it, which is the subject of the fight over Developing countries and developed markets like the U.S. Who is supposed to take the hit on its growth? Should Developing countries like India, China, Indonesia, and Brasil? or is it all due to sin is done by Developed countries like the US.

The industries like power, cement, steel, textile, fertilizer, and many others rely on fossil fuels (coal, electricity derived from coal, natural gas, and oil). The primary greenhouse gases emitted by these industries are carbon dioxide, methane, nitrous oxide, hydrofluorocarbons(HFCs), etc., all of which increase the atmosphere’s ability to trap infrared energy and thus affect the climate. The concept of carbon credits came into existence due to growing awareness of the need to control emissions.

To keep the emission of Such gases low, significant investments are needed. Who can do that? On the other hand, some industries are reducing Carbon footprints. The Kyoto protocol realized that it might be good to keep them interconnected, so it set up a mechanism to handle it. It is one of the successful mechanisms for handling Global warming.

Under Carbon credit, one carbon credit is equal to 1 tonne of Carbon dioxide or, in some markets, carbon dioxide equivalent gases. Greenhouse gas emissions are capped, and markets are used to allocate the emissions among the group of regulated sources.

In simple words, If you emit higher carbon than permitted, buy equal carbon credit equal to the amount excess of your emission and pay for it.

How big is this market?

Corporate behemoths like General Electric, DuPont, Johnson & Johnson, and others have come together to form the United States Climate Action Partnership. Even oil juggernauts like Shell, BP, and ConocoPhillips have joined this coalition, which calls itself “an expanding alliance of major businesses and leading climate and environmental groups that have come together to call on the federal government to enact legislation requiring significant reductions of greenhouse gas emissions.”

According to a recent New York Times article, carbon trading is one of the “fastest-growing specialties in financial services.” And companies are scrambling to get a slice of a market now worth well over 100 billion, which could grow to $1 trillion within a decade.

The article, “In London’s Financial World, Carbon Trading Is the New Big Thing,” goes on: “Carbon will be the world’s biggest commodity market, and it could become the world’s biggest market overall.”

If you doubt that assertion, consider this: Humans generate about 38 billion tons of carbon dioxide every year.

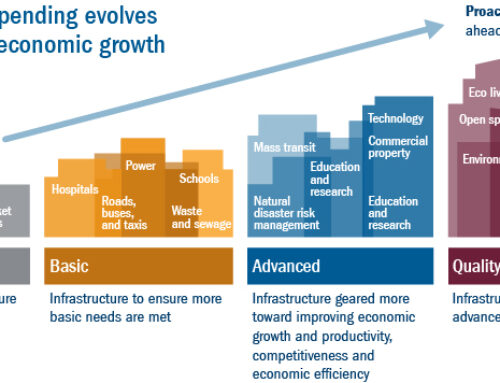

And that number will continue to grow as developing nations demand more energy that will likely be produced by coal and other carbon-heavy fuel sources.