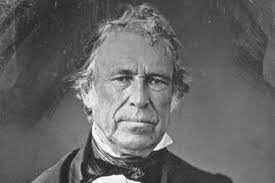

Zachary Taylor was the 12th President of the United States, serving from 1849 to 1850. He was born in Virginia in 1784 and later moved to Kentucky, where he became a successful military officer and plantation owner.

Taylor was a member of the Whig Party and was known for his strong support of states’ rights and a limited federal government. He was also a strong advocate for westward expansion and played a key role in the United States acquisition of new territories during his presidency.

One of the main challenges faced by Taylor during his presidency was the issue of slavery. He was a slave owner himself, but he was also opposed to the spread of slavery into new territories, believing that it was a divisive issue that threatened the unity of the country. Not shocking if I told you that he was a slave owner. 150, the third-highest number of slaves were owned by Zachary Taylor. Way above James Madison. (My respect for Madison increasing)

Despite his efforts to find a compromise solution to the issue, Taylor’s presidency was marked by tensions and conflict over slavery. He was unable to find a satisfactory resolution to the issue before his death in office in 1850, and it would eventually lead to the American Civil War just a decade later.

Despite his untimely death and the challenges he faced during his presidency, Taylor is remembered as a dedicated and effective leader. He is often ranked highly among historians and is remembered for his service to the country and his efforts to preserve the unity of the United States.

So what can I learn about finance from A guy, who didn’t vote for his election, was a hero of Mexican American war, whose daughter married Jefferson Devis, whose Son was a confederate soldier, and whose father was in the revolutionary war?

Ignorance can cost you big. On both ways.

Zachary Taylor ignored slavery, it become something that no one realise and his son and daughter went against the same. Your father fought to make the country independent and your daughter and son directly or indirectly. Another example of his ignorance is that for many years people were thinking that he dies due to poisoning. Just to put that all to rest, in 1991, his body was exhumed and tested for the same. The medical examiner reported that Taylor’s death was the result of a myriad of natural diseases which could have produced the symptoms of gastroenteritis.

So ignorance can damage your health and your wealth also.

I listen to too many people that mutual funds are Buy and Forget. This stock is Buy and Forget, that stock is Buy and forget. I can say no stock is Buy and Forget, Stock like Bajaj finance can easily find competition from Banks and sometimes other NBFCs. Stocks like Asian paints can be heavily valued and so maybe didn’t give a return for some time. Some companies which are sensitive to interest rates can find themselves on the wrong side of the river when rates are rising. Tobacco stock can be assumed as Buy and forget. But they are not. Government taxes can easily harm them.

For Mutual funds, I can say it all depends on the Fund manager, I saw it on my portfolio. UTI equity was one of the mutual fund schemes in my portfolio. when their fund manager stepped down, I saw the scheme was underperforming for some time. another example I saw was a Closed-ended scheme that was based on a good objective. That was a reason I loved it. I am not a guy who invests in Closed-ended mutual fund schemes. But as in half term, the fund manager changed, their performance changed and for quite some time, it didn’t even come close benchmark set for the scheme. Why? because when the Fund manager is leaving generally they are in the mindset that this is no longer my problem. whoever will come after me, will handle it. Ignorance costs you the return which you can make if you were not here. The opportunity cost of this may be big.

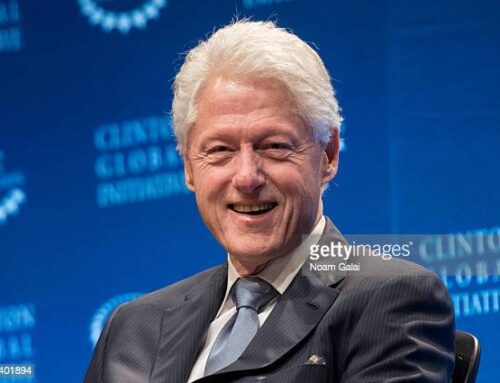

Warren Buffet is a name synonymous with Wall Street. When we talk about investors and investing and the world of finance, his name exists in the investment hall of fame. Warren Buffett famously stated that “diversification is protection against ignorance. It makes little sense if you know what you are doing.” In Buffet’s view, studying between one to three industries in great depth, learning their ins and outs, and using that knowledge to profit from those industries is more lucrative than spreading a portfolio across a broad array of sectors so that gains from certain sectors offset losses from others.

One thing you will never hear from your investment advisor is “you can’t own enough”, he’s more likely to follow the conventional wisdom which involves two things:

1) Money should be divided among stocks, bonds also a term deposit or savings account with cash

2) A stock portfolio should have a broad range of stocks, preferably diversified among a variety of industries and even different countries.

One of the fictions of investing is that diversification is a key to attaining great wealth. The point of this article is to prove that isn’t true. Diversification can prevent you from losing large sums of money, but no one ever joined the billionaire’s club through a great diversification strategy. In the view of Buffett and other like-minded investors, is that even though the risk is mitigated by sector gains offsetting sector losses, the opposite is also true – sector losses offset sector gains and reduce returns.

Every successful person, regardless of the field, is single-minded in the pursuit of his goal. They do NOT diversify their energies into a variety of fields. The result of such single-minded devotion to the achievement of one goal is Mastery. Like the diversified investor, the Jack of All Trades of None; is so rarely as successful as the person who devotes his entire energy to the single-minded pursuit of a single goal.