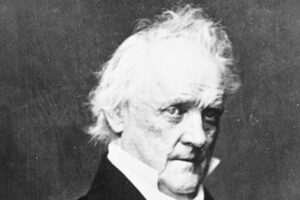

James Buchanan was the 15th President of the United States, serving from 1857 to 1861. He was born in Pennsylvania in 1791 and became a successful lawyer and politician.

Buchanan was a member of the Democratic Party and was known for his support of states’ rights and a limited federal government. He was also a strong advocate for westward expansion and played a vital role in the United States acquisition of new territories during his presidency.

One of the main challenges faced by Buchanan during his presidency was the issue of slavery. He was opposed to the abolition of slavery and believed that it was a states’ rights issue.

Despite his efforts to maintain the balance between the North and South, Buchanan’s presidency was marked by tensions and conflict over slavery. The Supreme Court’s decision in the Dred Scott case, which ruled that slaves were not citizens and had no rights, further inflamed tensions between the North and South.

Other challenges, including economic recession and foreign policy issues, also marked Buchanan’s presidency. He is often ranked as one of the least effective presidents in history due to his inability to address these challenges and the fact that he did not seek a second term. In fact, in many rankings, he was the least favorite. Some even credit him for civil war but that is not true as the issue already existed and some even unsuccessfully tried to solve it in their capacity

Despite his many challenges and limited accomplishments, Buchanan is remembered as a dedicated and courageous leader who served his country during a difficult and tumultuous time in its history.

So what are the things which you can learn from him? Well, maybe you can if you are a bachelor. Yes. He was the only bachelor president of the US.

Many people can talk about marriage and its finance. Getting married changes your financial life in profound ways. It’s not just that you’re living together or sharing expenses—you don’t need marriage to do that. It’s that your legal and tax statuses change. And while your credit score remains individual, your future choices could be changed by what your spouse brings into the financial picture. the decisions that you and your future spouse make about how to handle money will have long-term repercussions for you—not just as individuals, but as a couple, whether you choose to combine your finances completely or keep certain things separate.

But what about Being single?

The most important thing while you are single is to take risks Try something new. Don’t think much about what if this went wrong. especially if your age is sub-25. First things first. No matter what, making your budget is worth it. how much you are earning and what your expenditure is. If you don’t keep an eye out, you will need to learn about Thomas Jefferson.

Get out of debt. Debts are bad. Some people will tell you that some debts are good. They are only when you are making some sort of an asset. like Home. But if you already have one, it is great. In some countries, the family expects you to leave their house and make your own life. In India, it is not that way. We have permission to live with our family. so some things are a little better for us. But that makes us different on different levels. Many people will tell you that don’t take a loan. I will tell you that take a loan. take a loan but with the planning of how you are going to repay it. that make your credit history.

Here I want to give my example. I love to use cabs. Generally, whenever I went outside of my hometown, I prefer cabs for travel. One company, Ola made their Buy now pay later service. as one of the old customers they offered the option to me. I took it. Because I knew I was keeping money in my wallet to pay. So when the company gave me 7 days credit period. I was paying that in 2 or at most 3 days. Maybe the company was happy with me. because they kept on increasing the limit to its highest available, That’s it. I made a success by making a good credit score.

Early years are also important for your investment habit. Not only about your portfolio, but also about emergency funds. One of the best steps you can take in your 20s is to establish an emergency fund to cover any unexpected expenses that may arise, such as medical bills or car repairs. The money in your emergency fund can help you avoid taking out a loan or carrying a balance on a credit card, which can save you money on interest charges. Experts generally recommend putting three to six months of expenses into an emergency fund, but amid the coronavirus pandemic and high unemployment rates, some financial experts are offering more realistic advice about how much people should try to save. Instead, you should focus on saving as much as you can afford, after covering necessary bills. I wrote about it already So you may read it Emergency funds: why they are important.

Some things will be there, as they are part of your education life. education loan is one of them. for Indians this is not something big, but for Us citizens, yes. We Indians are lucky that our government gave us good education at a lower rate or with heavy subsidies.

It’s never too soon to start saving for retirement, and the earlier you start putting money toward your future, the more it can grow. When you get your first full-time job, your employer may offer a retirement account. In Us they have 401K. We have NPS. that you can open and deposit a percentage of every paycheck into each pay period.

Many employers also match your contributions up to a certain percentage, which is a great way to maximize savings. As a general rule of thumb, opt to save at least a percentage that is equal to your employer’s match. So if they match up to 6% of your contribution each paycheck, choose to transfer 6% or more to your 401(k) or NPS every pay period.

While taking this into account, finance for an unmarried couple is also important. Our society encourages marriage. Laws governing everything from living together to insurance to estate planning are written with married couples in mind. There are also default rules protecting surviving spouses when their partners die without a will.