Chester Arthur was the 21st President of the United States, serving from 1881 to 1885. He was born in Vermont in 1829 and became a successful lawyer and politician.

Arthur was a member of the Republican Party and was known for his support of civil service reform and a limited federal government. He was also a strong advocate for the rights of small farmers and played a key role in the United States Reconstruction efforts following the Civil War.

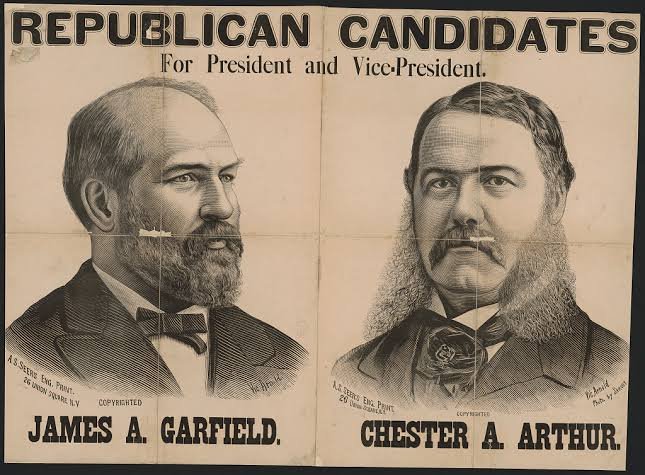

Arthur became President after the assassination of James Garfield in 1881 and faced many challenges during his presidency. One of the main challenges he faced was the issue of corruption in government, as he worked to reform the civil service and root out corrupt officials.

Arthur was also faced with significant economic challenges, including the continuing effects of the Panic of 1873 and the resulting depression. He worked to stabilize the economy and promote economic growth through a series of measures, including introducing the gold standard and reducing tariffs.

Despite his many challenges and limited accomplishments, Arthur is remembered as a dedicated and courageous leader who served his country during a difficult and tumultuous time in its history. He is often ranked as an average president due to his efforts to address the issues facing the country during his brief tenure.

US presidential term is very much a steady term. But 1881 was proved the year when 3 People were president in one year Rutherford B Hayes, James Garfield, and Chester Arthur. This happened when the United States was largely divided over many issues. Post the civil war era when the reconstruction era was going on and a few years back very much Divided elections and Deals between the Republicans and Democratic parties about the house and President. So Leadership qualities are something that I will say we can learn from him.

Chester A. Arthur was the 21st President of the United States, serving from 1881-1885. While his presidency was relatively uneventful, his life before his presidency was filled with interesting financial stories. Turning around new york custom house was one. In 1871, Arthur was appointed as the Collector of the Port of New York, which oversaw the New York Custom House. At the time, the Custom House was known for being corrupt and inefficient. However, Arthur implemented several reforms that helped turn it around, including improving record-keeping and cracking down on bribery. Under his leadership, the Custom House became more efficient and profitable, which helped him gain political connections and eventually led to his nomination as Vice President.

Customs taxes, also known as import tariffs, have been around for centuries and can be traced back to the ancient world. One of the earliest recorded instances of customs taxes can be found in the Code of Hammurabi, which was written in ancient Babylon around 1754 BC.

In the medieval period, customs taxes became an important source of revenue for European monarchs, who used them to fund their wars and other expenses. During this time, customs duties were often collected by local lords or merchants, who would then pass them on to the monarch.

In the early modern period, customs taxes became even more important as European countries began to expand their empires and engage in global trade. The Dutch Republic, for example, was one of the first countries to establish a national customs system, which helped to fuel its economic growth and dominance in global trade.

In the 19th and 20th centuries, customs taxes became an even more significant source of revenue for governments around the world, particularly as international trade grew and became more complex. Today, customs taxes remain an important part of the global economy, with many countries using them to fund government programs and services, protect domestic industries, and promote fair trade practices.

Customs taxes play a key role in economic development. Customs taxes, also known as import tariffs, are a source of revenue for governments. These taxes are levied on goods that are imported into a country, and the revenue generated can be used to fund various government programs and services, such as healthcare, education, and infrastructure development. Protection of domestic industries: Customs taxes can also be used to protect domestic industries from foreign competition. By imposing tariffs on imported goods, governments can make it more expensive for foreign companies to sell their products in the domestic market, thereby giving domestic producers a competitive advantage. This can help to promote the growth and development of domestic industries, which can in turn lead to job creation and economic growth. Control of trade: Customs taxes can also be used to control the flow of goods into and out of a country. Governments can use these taxes to restrict the import of certain goods that may be harmful to public health or safety or to regulate the export of certain strategic goods that may be needed for national security or other purposes. Encouragement of local production: Customs taxes can also be used to encourage the production of certain goods locally. By imposing higher tariffs on imported goods, governments can create a market advantage for local producers, which can lead to increased production and investment in local industries.

In summary, customs taxes play an important role in economic development by providing governments with a source of revenue, protecting domestic industries, controlling the flow of goods, encouraging local production, and promoting fair trade practices.