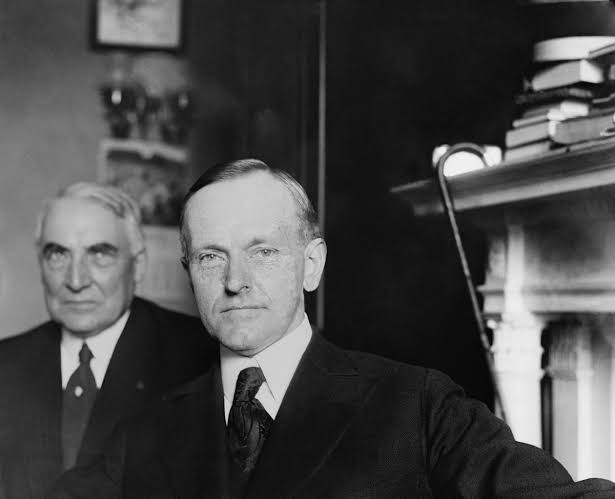

Calvin Coolidge was the 30th President of the United States, serving from 1923 to 1929. Born in Vermont in 1872, Coolidge was a lawyer and politician who rose through the ranks of the Republican Party to become a leader in the Massachusetts state government.

Coolidge is perhaps best known for his role in leading the country through a period of economic prosperity in the 1920s, known as the “Roaring Twenties.” He was a fiscal conservative. During his presidency, Coolidge implemented several policies aimed at reducing government intervention in the economy Promoting and fostering growth. These included cutting taxes, reducing government spending, and supporting free trade. One of his most notable financial achievements was the signing of the Revenue Act of 1926, which lowered income tax rates for most Americans and helped spur economic growth.

Coolidge was also known for his quiet, reserved demeanor and his aversion to public speaking. He once said, “I do not choose to run,” when asked if he would seek a second term in office. Despite this, Coolidge’s presidency was marked by several important events, including the passage of the Revenue Act of 1926, which reduced taxes on the wealthy, and the construction of the Hoover Dam.

Coolidge’s presidency came to an end in 1929, when he decided not to seek re-election. He died in 1933 and is remembered as a President who helped lead the country through a period of economic growth and prosperity.

Despite his efforts to promote fiscal responsibility, Coolidge’s presidency was not without financial challenges. The stock market crash of 1929 occurred just a few months after he left office, leading to the Great Depression and a period of economic hardship for many Americans.

“After order and liberty, economy is one of the highest essentials of a free government.” Calvin Coolidge said.

Even though Coolidge was much more likely to say “no” to requests for spending than Harding, both presidents made great strides in cutting taxes, balancing the federal budget, and reducing unemployment in the United States during the 1920s. “Some presidents are known for their work on foreign policy, others for regulation . . . Coolidge should be known as the economic president who cut and did budgeting,” Amity Shlaes said. In 1926 Coolidge, as president, brought the rate down to 25%, which is still the gold standard for tax cuts today. Coolidge had weekly budget meetings so that he would be well-equipped to say no, and he berated government departments that overspent or didn’t cut spending. The media called him a “wet blanket, but technically marvelous” president who used “dullness and boredom as political devices,”

When asked about the lessons of the 1920s for today’s policymakers, Shlaes said: “I find value in history. In the 1920-1921 recession, unemployment was 15% in some cities in the U.S. . . . Harding and Coolidge cut unemployment by half. They raised interest rates by 300 basis points from low levels and cut government spending also by half. The recession was over in six months!”

Coolidge’s legacy as a fiscal conservative continues to be studied and debated by economists and policymakers today, with some viewing his policies as an example of responsible government stewardship and others criticizing his approach as overly focused on cutting government spending at the expense of social programs and public investment.

So what is one thing which You can learn from him in finance?

I don’t know how many times I talked about trickle-down economics but here I want to talk about it again. I studied how trickle-down works and I agreed that in some cases reducing taxes will help but that tax need to become a real burden. which is not in every case. Tax is double edge sword. It is an income of the government but also it’s a way for the government to tell what is right or wrong. Coolidge was a firm believer in limiting government spending and reducing the size of the federal government. He vetoed several bills that he believed would lead to excessive government spending, including a proposed bonus for World War I veterans. as someone who lives in the 21st century I do not agree with his policies. He was a republican and he was more transitory. He was not alone responsible for the 1929 crash and recession but can’t deny his responsibility as the miller center article rightfully highlights about it,

It would be unfair to blame Coolidge for sharing the prevalent optimism of his time. In retrospect, however, it became apparent that his policies contributed to the stock market crash of 1929 and the Great Depression that followed. His fiscal policy encouraged speculation and ignored inequality, as the flow of dollars into the pockets of the wealthy helped tip the healthy investment of the mid-1920s into the gambling that followed. His hands-off regulatory policy took its toll, especially in the financial arena, where the dangerous practice of margin trading was allowed to flourish unrestrained. And for all the heady growth of the 1920s, Coolidge’s policies exacerbated the uneven distribution of income and buying power, which led to the overproduction of goods for which there were not enough affluent consumers.

Making matters worse, Coolidge failed to address the worsening economic plight of farmers. Many farm-state progressives embraced a panacea known as McNary-Haugenism, based on a proposal dating back to 1921 that would have established a government corporation to buy surplus crops at artificially set prices (to be held or sold abroad when market prices rose). Although the scheme might have shored up the depressed farm economy, it would have encouraged overproduction, hurt consumers, and posed dangers to the international system.

One of Coolidge’s key economic policies was his commitment to reducing government spending and limiting the role of the federal government in the economy. While this policy was successful in reducing the federal budget deficit and promoting economic growth during the 1920s, it also led to a lack of government intervention during the early years of the Great Depression, which many economists argue worsened the economic crisis.

Coolidge’s commitment to the gold standard, which fixed the value of the dollar to a specific amount of gold, also limited the ability of the government to respond to the economic crisis. Some economists argue that abandoning the gold standard earlier and implementing policies such as deficit spending and monetary easing could have helped to alleviate the worst effects of the Great Depression.

In more simple term, I will say that Calvin college was one cool guy who was trying to keep systems in order when it need big overhaul.