Statutory liquidity ratio ( SLR) is the Indian government term for reserve requirement that the commercial banks in India require to maintain in the form of gold, cash or government approved securities like bonds and debentures issued by government, before providing credit to the customers. Statutory Liquidity Ratio is determined and maintained by Reserve Bank of India in order to control the expansion of bank credit and relative effect on money supply in economics and relative effect on inflation. (Wikipedia)

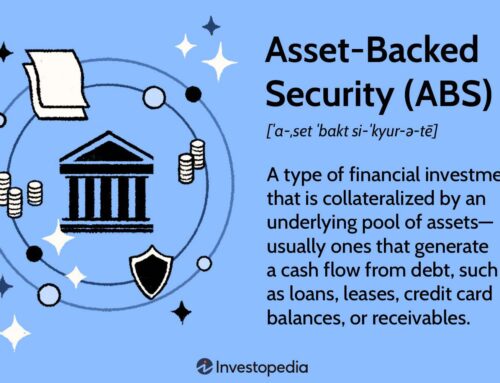

SLR is a double edge sword. It provides a tool to banks for hedging against the future insecurity of liquidity, and at the same time, it provides a source of income to the Government for its expenditure. It also gives the benchmark for RFR (risk-free rate of return ) for calculations of Corporate finance. What is the reality? Because of SLR, it is mandatory for banks and some financial institutions to buy Government bonds. It is good practice for the Government as it is a source of income. In the Indian economy, very few peoples are eligible to pay Income tax. 24% income for govt is Debt. And 14% is the income tax. Other sources of income for the Government are company tax(20%), income from disinvestment ( 4%), Customs duty ( 9%), ( ref from no. Given in Central budget 2015-16), and So on developing the undeveloped. The Government must borrow money from the open market. So it made it difficult for the Government to live peacefully as now interest ( villain) came into the picture. As per the budget estimate, the Government will spend 20% of its income on the repayment of interest and matured Debt. Which is the 2nd most significant expense in the budget after payment to states of their parts? In other words, the Government is taking a new loan to repay the old one.

There is another effect of it. As RBI is the banker to the Government, it is supposed to borrow money and repay it to the Government. RBI is also printing money for the whole economy and controlling the supply of money. The money supply is decided on many factors, not one. But because of interest on govt loans, this extra amount is also added to the circulation, and the new amount is high. As of now, there are no goods or services to balance this. It is like junk money, which causes a reduction of the currency’s value, which indirectly came in front of as INFLATION. There is another aspect of the issue. As RBI is an Investment banker of the Government, it is supposed to make Government bonds attractive. For this, it maintains the interest rates high with its power. It affects the interest rates and growth as Debt from banks is one source in India for capital.

THEN WHAT TO DO? Nothing. As it is not in your and my hand. But what is a possible way for the Government and RBI governor is doing the same thing is, ABOLISH SLR WHY? WHAT WILL HAPPEN THEN? There will be no way for the Government to make it mandatory but to collect taxes and Capital Gains and Divided from Public Sector Undertakings. So there will be more space for investing in infrastructure, which is impossible now. I want to finish this writing with a different thought Effect of compounding if we decide to pay time. IT WILL REDUCE GOVERNMENT EXPENDITURE BY 8% INTEREST. SO GOVERNMENT WILL GIVE YOU A DEDUCTION TOMORROW.