As a blogger, I wrote many posts on this blog, on different topics. As an analyst, I analyze many companies and that is a big part of my blog. But I realize that I hardly talked about basic things such as Debt and equity. I wrote about the debt ceiling, the Yield curve, and many more things. But still not much about basics about this topic. So I decided to write this one important subject.

When we think about debt, we think about it as a bad thing. My series about US presidents gave me the idea that even Some US Presidents were bankrupt. The story of William McKinley Is really interesting.

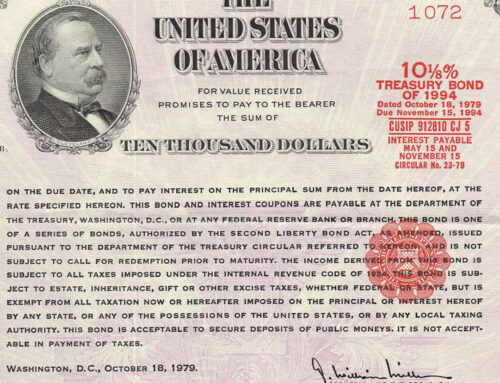

Debt is a form of capital that can be used to finance a business’s growth. It is a loan that must be repaid with interest, but it can provide businesses with access to capital that they would not otherwise be able to obtain.

There are several advantages to using debt as capital. First, debt is often cheaper than equity. This is because lenders are typically willing to lend money to businesses at a lower interest rate than investors are willing to invest money. Second, debt does not dilute ownership. When a business issues equity, it sells a portion of ownership to investors. This can give investors control over the business and reduce the control the original owners have. Third, debt can help to improve a business’s credit rating. This can make it easier for the business to obtain future loans and lower the interest rate on those loans.

Of course, there are also some disadvantages to using debt as capital. First, the debt must be repaid. This means that businesses must have a plan to generate enough cash flow to cover their debt payments. Second, if a company is unable to make its debt payments, it could go bankrupt. This could have a devastating impact on the business and its owners.

Debt and equity are two different forms of capital that can be used to finance a business. Debt is a loan that must be repaid with interest, while equity is an investment in the business that does not have to be repaid.

There are several key differences between debt and equity as capital. First, debt is a liability for the business, while equity is an asset. This means that debt must be repaid, while equity represents ownership in the business. Second, debt payments are typically fixed, while dividends on equity are not. This means that the amount of money that a business must pay on its debt is known, while the amount of money that it will pay to its shareholders is not. Third, debt can be secured or unsecured. Secured debt is backed by an asset, such as a property. Unsecured debt is not backed by any asset.

The choice of whether to use debt or equity as capital depends on several factors, including the business’s financial situation, its growth plans, and its risk tolerance.

Debt can be a valuable source of capital for businesses. However, it is important to weigh the risks and benefits of using debt before making a decision. If a business is considering using debt, it should carefully evaluate its financial situation and its growth plans. It should also make sure that it has a plan to generate enough cash flow to cover its debt payments.