Fixed-income securities play a crucial role in the investment landscape, offering a steady stream of income to investors while preserving their principal. These securities, which include bonds and other debt instruments, are widely popular due to their relative stability and predictable returns. However, navigating the fixed-income world can be daunting, especially for newcomers. In this blog post, we will demystify some essential terms related to fixed-income securities, enabling you to make informed investment decisions.

Par value, also known as face value, is the stated value of a financial instrument at the time it is issued. It is most commonly used with bonds, but can also be used with stocks. In simple terms, The nominal value of a bond or fixed-income security that is repaid to the bondholder at maturity. It is also used to calculate coupon payments.

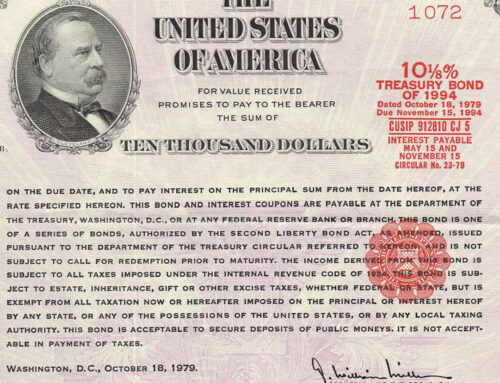

With bonds, the par value is the amount of money that the bond issuer agrees to repay to the bondholder at the bond’s maturity. This is the amount that the bondholder is essentially lending to the issuer. The bond issuer will also make periodic interest payments to the bondholder, typically semiannually. The amount of these interest payments is calculated as a percentage of the par value.

For example, if a bond has a par value of $1,000 and a coupon rate of 5%, the bondholder will receive $50 in interest payments every six months.

The par value of a bond is not necessarily the same as its market value. The market value of a bond is the price that it is trading for on the secondary market. The market value of a bond can fluctuate based on a number of factors, including interest rates, the creditworthiness of the issuer, and the length of time until maturity.

If the market value of a bond is below par value, it is said to be trading at a discount. If the market value of a bond is above par value, it is said to be trading at a premium.

The par value of a bond is important because it is the amount that the bondholder is entitled to receive at maturity. If the bond issuer defaults on its obligations, the bondholder is only entitled to receive the par value of the bond.

Coupon: A coupon in fixed income is a periodic interest payment made by a bond issuer to the bondholder. Coupons are typically paid semiannually, but they can be paid monthly, quarterly, or annually. The amount of the coupon payment is determined by the coupon rate, which is expressed as a percentage of the bond’s face value. The coupon rate is The fixed interest rate stated on a bond, which is used to calculate the periodic coupon payments. It is usually expressed as a percentage of the bond’s face value.

The coupon rate is an important factor to consider when investing in bonds. It is a way to measure the income that a bondholder can expect to receive from a bond. However, it is important to remember that the YTM or Yield to maturity is the total return that an investor expects to receive from a bond, and it can be different from the coupon rate. The YTM is the total return that an investor expects to receive from a bond, including both the coupon payments and the price appreciation (or depreciation) of the bond. The YTM is calculated as a percentage of the bond’s face value, and it is different from the coupon rate.

The yield represents the return on investment generated by fixed-income security.

- Current Yield: The annual interest income of the bond divided by its current market price.

- Yield to Maturity (YTM): The total return anticipated on a bond if it is held until maturity, considering its current price, coupon payments, and time to maturity.

- Yield to Call (YTC): Similar to YTM, but considers the possibility that the issuer may “call” (redeem) the bond before its maturity date.

You will find all this in the prospectus. A prospectus of a fixed-income security is a legal document provided by the issuer to potential investors. It contains essential information about the security being offered and serves as a comprehensive guide for investors to make informed decisions. The prospectus is a critical disclosure document that ensures transparency and regulatory compliance in the issuance and sale of fixed-income securities. Let’s dive into the key components of a prospectus for fixed-income securities:

- Issuer Information: The prospectus begins by providing details about the entity issuing the fixed-income security. This includes the name of the issuer, its legal status (corporation, government agency, etc.), contact information, and any relevant background information.

- Security Description: A prospectus includes a clear description of the fixed-income security being offered. It identifies the type of security (e.g., bond, note), its maturity date, interest rate (coupon rate), and any special features such as callability or putability.

- Purpose of the Issue: The issuer outlines the reasons for raising funds through the issuance of a fixed-income security. This section typically includes information about the projects or activities that the proceeds will finance.

- Terms and Conditions: The prospectus provides detailed terms and conditions of the fixed income security, including the coupon payment frequency (annual, semi-annual), the method of interest payment, the maturity date, and any other relevant dates related to the security.

- Risk Factors: This section highlights the risks associated with investing in fixed-income security. These risks may include credit risk (the risk of issuer default), interest rate risk (the impact of changing interest rates on the security’s value), liquidity risk, and other potential risks that may affect the security’s performance.

- Use of Proceeds: The issuer specifies how it intends to use the funds raised from selling the fixed-income security. The breakdown of how the funds will be allocated can give investors insights into the issuer’s financial goals.

- Tax Information: Fixed-income securities often have specific tax implications. The prospectus includes details on the tax treatment of interest income, potential tax advantages, or any tax-exempt status that may apply.

- Financial Statements: To provide investors with a comprehensive view of the issuer’s financial health, the prospectus may include audited financial statements, such as the balance sheet, income statement, and cash flow statement.

- Credit Rating: If available, the prospectus may mention the credit rating assigned to the fixed-income security by reputable credit rating agencies. The rating provides an independent assessment of the issuer’s creditworthiness.

- Offering Details: This section specifies the total size of the offering, the price at which the fixed-income security will be sold (the offering price), and any underwriting arrangements or commission fees involved in the offering process.

- Legal and Regulatory Information: The prospectus includes legal disclaimers, regulatory compliance statements, and details about the governing laws that apply to the offering and fixed-income security.

- Issuer Background and Management: Some prospectuses include information about the issuer’s management team and their qualifications, as well as an overview of the issuer’s business operations.