After the Mini Budget of Kwasi Kwarteng, the market gave its reaction, which was one big reason many things went wrong in Britain for quite some time. The Bank of England, the central bank of the British economy, took steps to buy long-dated UK government bonds. How much that helped or what damage that did was a big subject of debate, as it was hard on pension funds. But it highlights the importance of the central bank. even in today’s world.

Be it the 2008 financial crisis or the Global pandemic, the Federal Reserve shows us its fiscal muscle and starts buying assets.

The Federal Reserve, European Central Bank, Reserve Bank of India, Bank of Canada, Reserve Bank of New Zealand, Bank of Japan, and Chinese Central Bank all play key roles in the Global debt market. I can’t identify them while writing about their role in it, so in this post, I will talk about the Role of the central bank in the global debt market.

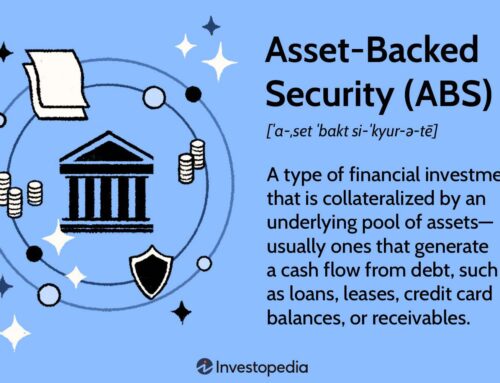

The debt market is a vital component of any modern economy, facilitating the flow of funds between borrowers and lenders. Within this complex financial ecosystem, central banks play a multifaceted and pivotal role that extends far beyond their traditional mandates of monetary policy and currency issuance. In this blog post, I will delve into the various functions of central banks in the debt market, highlighting their significance in ensuring stability, liquidity, and effective functioning.

- Monetary Policy Implementation:

Central banks utilize the debt market as a critical tool to implement monetary policy. Through mechanisms like open market operations, central banks buy or sell government securities to influence the money supply and interest rates. When a central bank wants to expand the money supply, it purchases government bonds from financial institutions, injecting liquidity into the system. Conversely, when it aims to reduce inflationary pressures, it sells government bonds, absorbing excess funds from the market. These actions have a direct impact on interest rates and credit availability, which in turn influence economic activity and borrowing costs. These operations help central banks achieve their policy goals, which often include controlling inflation, supporting economic growth, and maintaining financial stability.

The Federal Reserve is one of the most influential central banks globally. It conducts open market operations through the Federal Open Market Committee (FOMC). The Fed uses OMOs to achieve its target for the federal funds rate. Federal Fu ds rates are interest rates at which depository institutions lend reserves to each other overnight. By buying or selling U.S. government securities, the Fed influences the level of reserves in the banking system, thus affecting the federal funds rate. In times of economic expansion, the Fed may reduce reserves by selling securities to increase interest rates, while during economic downturns, it may buy securities to inject liquidity and lower rates.

The European Central Bank (ECB) conducts open market operations through its Monetary Policy Implementation Framework. It uses OMOs to steer short-term interest rates, particularly the Euro Overnight Index Average (EONIA) and the Euro Short-Term Rate (€STR). The ECB conducts main refinancing operations (MROs), which are regular liquidity-providing operations, as well as longer-term refinancing operations (LTROs) to provide longer-term funding to banks. The ECB also engages in outright asset purchases, such as its Quantitative Easing (QE) programs, to address broader economic and financial stability objectives.

The Bank of England uses open market operations to implement its monetary policy decisions. It conducts regular auctions known as Reverse Repo Operations (RROs), where financial institutions can lend government securities to the BoE in exchange for cash. These operations help manage the supply of reserves in the banking system and influence short-term interest rates. The BoE also uses outright asset purchases, known as Quantitative Easing (QE), to provide additional stimulus during economic downturns.

- Market Liquidity Management:

Central banks act as a crucial source of liquidity in the debt market. During times of financial stress or market turbulence, they can provide emergency funds to financial institutions by accepting government securities as collateral. This helps maintain market stability and prevents a potential credit crunch. Central banks’ ability to inject liquidity is particularly vital during crises, as witnessed during the global financial crisis of 2008 and the COVID-19 pandemic.

The decision to inject liquidity is guided by a combination of factors, including the central bank’s assessment of market conditions, potential risks, and the overall economic impact. Central banks closely monitor various financial indicators and market developments to gauge the level of stress and potential disruptions. They keep an eye on many aspects, like Government Bond yields and interbank lending rates. Big movements in those can highlight stress in the market.

If there is a shortage of liquidity in the banking system or if financial institutions are facing difficulties obtaining short-term funding, it can exacerbate financial stress. Central banks aim to prevent a liquidity crunch that could lead to a credit freeze or a broader economic downturn. Central banks analyze potential systemic risks that could arise from a lack of liquidity. If the stress in the debt market spills over into other parts of the financial system, it could lead to a domino effect of financial institution failures and market disruptions.

-

Government Debt Issuance and Management:

Central banks often play a role in the issuance and management of government debt. They may act as intermediaries in the primary market, facilitating the sale of government bonds to investors. By participating in government debt auctions, central banks help ensure the smooth issuance of debt and contribute to the government’s funding needs. Additionally, central banks may engage in secondary market purchases or sales of government securities to influence yields and market sentiment. many central banks including the Reserve Bank of India need to play both roles as bankers for the government while issuing the debt instrument and regulator of the debt market. this makes them crucial, For the federal reserve, this role is different but as an active player in the global market, we can’t ignore them.

-

Interest Rate Guidance:

Central banks’ actions and statements regarding their debt market operations can provide valuable signals to market participants about the future direction of interest rates. Forward guidance, a communication strategy employed by central banks helps shape market expectations and influence borrowing and investment decisions. By effectively managing market expectations, central banks can enhance their ability to steer the economy toward their policy objectives.

-

Risk Management:

Central banks also engage in risk management activities within the debt market. They may hold government securities and other assets in their reserves to safeguard against potential economic and financial shocks. These reserves provide a buffer that central banks can deploy to stabilize markets and currencies during periods of uncertainty.

Central banks are vigilant in identifying, assessing, and mitigating various risks that can arise within the debt market. Central banks closely monitor interest rate movements and potential shifts in yield curves. As a Portfolio Manager of government, this is another objective for Central banks. Central banks issue their own liabilities, such as currency or central bank reserves. They are at the core of the financial system. They need to be managed to ensure they can be refinanced at reasonable terms. Some Central banks hold foreign currency-denominated assets or engage in currency swaps. That is another explanation of the Central Bank managing risk.

-

Influence on Yield Curve:

Through their debt market operations, central banks have the power to influence the shape and dynamics of the yield curve. The yield curve represents the relationship between the maturity of debt securities and their corresponding yields. By altering the supply and demand dynamics of different maturities through open market operations, central banks can impact the slope and steepness of the yield curve, which in turn affects lending rates across the economy.

Conclusion:

Central banks wield substantial influence in the debt market, far beyond their traditional roles as guardians of monetary policy and currency stability. Their actions in the debt market have far-reaching consequences, touching upon economic growth, financial stability, and market confidence. As economic landscapes evolve and financial systems become increasingly interconnected, central banks’ role in the debt market remains an essential tool for shaping and managing economies in a dynamic and ever-changing.