When I am talking about debt as Capital, I need to talk about the debt market also. Just like Equity instruments, different debt instruments exist. The equity market and the debt market are two of the most important financial markets in the world. The debt market is where debt instruments trade like equity instruments trade in the Equity market. They provide a way for businesses to raise capital, and they offer investors a variety of investment opportunities. Just like the Equity market, the Debt market plays an important role in capital markets and financial systems.

Equity markets and debt markets are not perfectly correlated. This means that they do not always move in the same direction. However, there is a general trend for equity markets and debt markets to move in the same direction. This is because both markets are sensitive to economic conditions. When the economy is doing well, both equity markets and debt markets tend to do well. However, when the economy is doing poorly, both equity markets and debt markets tend to do poorly.

Debt markets are way bigger than equity markets. As there are not all equity securities are listed and it is difficult to value unlisted securities, with some assumptions and estimates, The total value of the equity market is estimated to be over $100 trillion. This is the value of all the shares of stock that are traded on stock exchanges around the world. The value of the global equity market has fluctuated over the years, but it has generally trended upwards. In 2022, the value of the global equity market reached a peak of $108.23 trillion. However, since then, the value of the market has declined as a result of rising interest rates and concerns about a recession.

The largest equity markets in the world are the United States, China, Japan, and the United Kingdom. The United States equity market is the largest in the world, with a market capitalization of around $40 trillion. The Chinese equity market is the second largest, with a market capitalization of around $25 trillion. The Japanese equity market is the third largest, with a market capitalization of around $10 trillion. The United Kingdom equity market is the fourth largest, with a market capitalization of around $7 trillion.

The value of the global debt market has fluctuated over the years, but it has generally trended upwards. In 2022, the value of the global debt market reached a peak of $154.3 trillion. However, since then, the value of the market has declined as a result of rising interest rates and concerns about a recession.

The largest debt markets in the world are the United States, China, Japan, and the United Kingdom. The United States debt market is the largest in the world, with a market capitalization of around $50 trillion. The Chinese debt market is the second largest, with a market capitalization of around $25 trillion. The Japanese debt market is the third largest, with a market capitalization of around $10 trillion. The United Kingdom debt market is the fourth largest, with a market capitalization of around $7 trillion.

The global debt market is a major driver of economic growth. When the debt market is doing well, it means that businesses and governments are able to borrow money at low-interest rates. This can lead to increased investment and economic growth. However, when the debt market is doing poorly, it can lead to decreased investment and economic growth.

The global debt market is a vast and complex ecosystem with a wide range of participants. Some of the key players include:

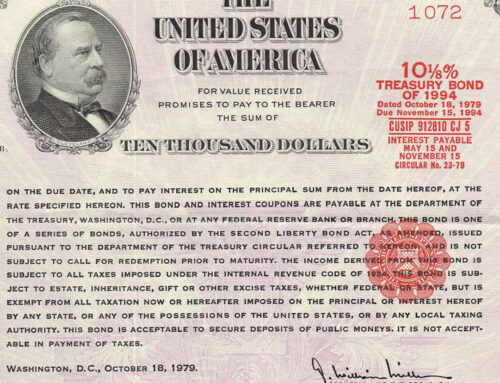

- Governments: Governments are the largest issuers of debt in the world. They borrow money to finance their spending, and they issue a variety of debt instruments, including treasury bills, notes and bonds. Governments issue debt to finance their spending, which can include anything from infrastructure projects to social programs. The interest rates that governments pay on their debt are typically influenced by a number of factors, including the country’s economic outlook and its credit rating.

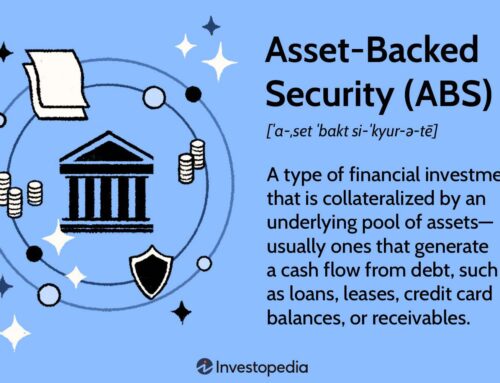

- Corporations: Corporations issue debt to finance their operations, which can include anything from buying new equipment to expanding their business. They typically issue bonds, but they may also issue other debt instruments, such as commercial paper. The interest rates that corporations pay on their debt are typically influenced by a number of factors, including the company’s creditworthiness and the overall health of the economy.

- Financial institutions: Financial institutions, such as banks and insurance companies, are major players in the debt market. They buy and sell debt instruments as part of their investment activities, and they also provide loans to governments and corporations. The interest rates that financial institutions charge on their loans are typically influenced by a number of factors, including the riskiness of the borrower and the current market conditions.

- Hedge funds: Hedge funds are a type of investment fund that uses a variety of strategies to generate returns. They may invest in debt instruments, and they may also use derivatives to hedge their risks. The interest rates that hedge funds earn on their investments are typically influenced by a number of factors, including the overall performance of the market and the specific strategies that they use.

- Individual investors: Individual investors also participate in the debt market. They may buy and sell debt instruments directly, or they may invest in mutual funds or exchange-traded funds that hold debt instruments. The interest rates that individual investors earn on their investments are typically influenced by a number of factors, including the type of debt instrument that they invest in and the overall performance of the market.

The global debt market is a dynamic and ever-changing market. The participants in the market are constantly evolving, and the types of debt instruments that are traded are also constantly changing. However, the key players that I have mentioned above are likely to remain important participants in the global debt market for many years to come.

Intermediaries in the global debt market are entities that facilitate the flow of debt capital between borrowers and investors. They do this by providing a variety of services, such as underwriting, trading, and research. There are a number of different types of intermediaries in the global debt market, including:

- Banks: Banks are one of the most important types of intermediaries in the debt market. They provide a variety of debt services, such as underwriting, trading, and lending.

- Investment banks: Investment banks are specialized in providing debt underwriting and advisory services. They help borrowers to issue debt securities and investors to buy and sell debt securities.

- Broker-dealers: Broker-dealers are intermediaries that facilitate the trading of debt securities. They connect buyers and sellers of debt securities and earn commissions on the trades that they facilitate.

- Rating agencies: Rating agencies assess the creditworthiness of borrowers and assign ratings to debt securities. These ratings help investors to assess the risk of investing in debt securities.

- Depository institutions: Depository institutions, such as commercial banks and savings institutions, hold debt securities on their balance sheets. They provide a safe haven for debt securities and also provide liquidity to the debt market.

The role of intermediaries in the global debt market

Intermediaries play a vital role in the global debt market. They help to connect borrowers and investors, facilitate the trading of debt securities, and assess the creditworthiness of borrowers. Without intermediaries, the global debt market would be much less efficient and would be more difficult for borrowers and investors to participate in.

The importance of intermediaries in the global debt market

The importance of intermediaries in the global debt market can be seen in a number of ways. First, intermediaries help to increase the liquidity of the debt market. This means that it is easier for borrowers to issue debt securities and for investors to buy and sell debt securities. Second, intermediaries help to reduce the cost of debt capital. This is because they can pool the capital of many investors and lend it to borrowers at a lower cost. Third, intermediaries help to improve the efficiency of the debt market. This is because they can provide borrowers and investors with access to information and analysis that would not be available to them otherwise.

The future of intermediaries in the global debt market

The future of intermediaries in the global debt market is uncertain. However, it is likely that they will continue to play an important role in the market. This is because they provide a number of valuable services that are essential to the efficient functioning of the market.

In addition to the traditional intermediaries mentioned above, there are a number of new intermediaries that are emerging in the global debt market. These include:

- FinTech companies: FinTech companies are using technology to provide new debt services, such as peer-to-peer lending and crowdfunding.

- Commodity trading advisors (CTAs): CTAs are investment advisors that specialize in trading debt securities. They use a variety of strategies to generate returns for their clients.

- Hedge funds: Hedge funds are investment funds that use a variety of strategies to generate returns. They may invest in debt securities, and they may also use derivatives to hedge their risks.

These new intermediaries are providing new and innovative debt services that are changing the way that the debt market operates. It will be interesting to see how these new intermediaries develop and how they impact the global debt market in the future.