Assets are significant for the company. How much? It is always the assets and not liabilities that make the company unique. I mean, what is there on the liability and equity side? Bank loan? Equity? Reserves and Undistributed profits? Debenture, Bonds? Well, they are always there. Cash Balance and Bank Balance Debtors are also the same in many companies. So long-term or fixed assets are the facts that make the company what it is.

So what is the importance of this ratio?

This ratio tells us what is happening with the company? Is it utilizing the total capacity of its assets? Is there any trend? Is the policy of depreciation right or wrong?

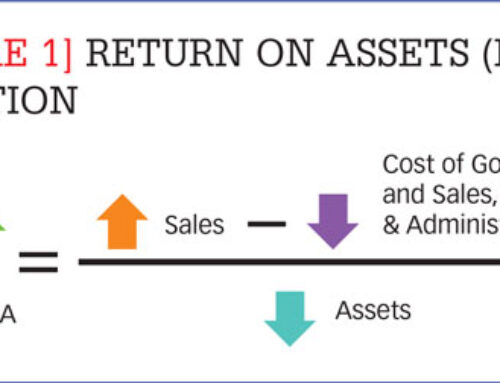

As per Investopedia, The Asset Turnover ratio can often be used as an indicator of the efficiency with which a company is deploying its assets in generating revenue.

The higher the ratio, the better the financial performance of the company. But what makes the performance of the company?

Under the Inflation condition, the inventory is sold at a higher price, and the company makes higher revenue.

Higher revenue and assets due to internal buildup or acquisition make the ratio a little unattractive here, and we need to analyze other Ratios and numbers.

Higher revenue but lower assets may sometimes look regular as fixed assets are subject to depreciation. Still, if the company can generate more cash or other assets, then it is much better.

Lower revenue but higher assets mean that the company cannot generate sufficient revenue. More insufficient Assets and lower-income are set for worse companies. More or less, the ratio is supposed to be the same. If there is any significant change, we need to analyze

There are many reasons for a lower ratio. Inventory may be obsolete. No demand in the industry. Higher collection period. Etc.

Every industry has there own industry parameters. For example, utility companies have their own and insurance, Asset management, Banking has their own. The ratio of research-based companies where intangible assets are on the balance sheet looks different than in Mining companies.

Before going out, I want to tell you that no one ratio is correct to analyze a whole company.