Equity markets in India are always in the news. They are always the star and getting the limelight. But With equity, debt is also one asset class. Debt is also one way through which companies raise money. The debt market is more crowded than the equity market. There are governments, quasi governments, Non-listed companies, some startups, some financial institutions, Some entities like the world bank, IMF, and bank for international settlement, etc. They only exist in the Debt market. This market did some essential things which are impossible for the equity market. But the investors here are the majority of institutions. Yes. Retail investors do invest but with Mutual funds.

Recently, Govt of India declared that soon they would start Corporate Bond ETF. So I saw this as a great starting point.

CPSE ETF made the concept of ETF known to the household. Though a little bit different, Investors in India love this new way. The reason is it is less costly than mutual funds. Moreover, trading mutual funds on the exchange are complicated, but not for ETFs. This sounds great when you use these advantages to develop the corporate debt market in India.

Regarding the corporate debt market, in India, only banks dominate this section. Even if you removed some big names like SBI, ICICI Bank, HDFC Bank, and Axis bank, Few big words remain. Recently SEBI made it mandatory to raise 25% of debt through the Corporate debt market, which sounds like music. When Sovereign or quasi-sovereign companies or PSUs have their ETF, I believe that it is their UTI movement. The way UTI channelizes household savings for the betterment of the economy, I am watching it in the same way.

Right now, there are a few ways to park your short-term funds with less risk and the expectation of a little bit of high interest. FDs are there, but the liquidity is low. Savings accounts give high liquidity, but the interest is expected. Corporate mutual funds are there, but their risk is not hidden.

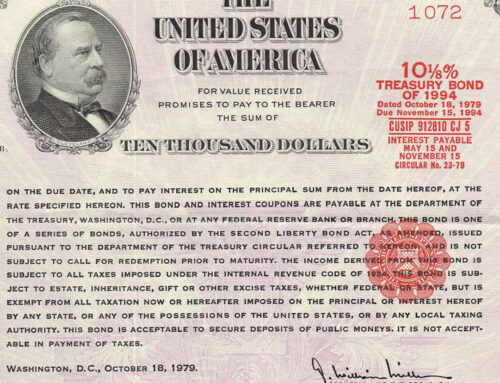

An ETF of PSU, Sovereign, or Quosi Sovereign is perfect for anyone who needs a little bit of security, with good liquidity and some good quality of assets. A Bharat Bond ETF may be the right tool. But as I learn in my CFA time, only one problem with Bond ETFs is that they are not perpetual. There is always a maturity date for every bond. How govt are going to handle it is a big issue.