Debt Instrument is financial security in which the borrower (issuer) owes the lender (investor) a specified amount of money, called the principal, along with periodic interest payments. The debt instrument provides the lender with a legal claim to the borrower’s assets if the borrower defaults on the loan.

Debt instruments can be classified based on several factors: the issuer, maturity, underlying assets, risk profile, and market characteristics. The classification of debt instruments helps investors and market participants understand their characteristics, risks, and potential returns.

- Issuer: Debt instruments can be classified based on the entity issuing them, such as government, corporations, municipalities, or financial institutions. This classification helps investors differentiate between the creditworthiness and risk associated with different issuers.

- Maturity: Debt instruments can be classified based on their maturity dates. Short-term debt instruments typically have maturities of one year or less, while medium-term and long-term debt instruments have longer maturities. This classification helps investors match their investment horizons and liquidity needs.

- Interest Rate: Debt instruments can be classified based on their interest rate structures. Fixed-rate instruments have a predetermined interest rate that remains constant throughout the instrument’s term. Floating-rate tools have interest rates that adjust periodically based on a reference benchmark. This classification helps investors understand how the interest income will vary over time.

- Collateral or Asset-Backed: Debt instruments can be classified based on whether they are backed by collateral or specific assets. Mortgage-backed securities (MBS), asset-backed securities (ABS), and collateralized debt obligations (CDOs) are examples of debt instruments backed by underlying assets. This classification helps investors assess the risk associated with the underlying collateral.

- Risk Profile: Debt instruments can be classified based on their credit ratings or risk profiles. Credit rating agencies assign ratings to debt instruments based on the issuer’s creditworthiness. Standard ratings include investment-grade (lower risk) and high-yield or junk bonds (higher risk). This classification helps investors gauge the potential default risk and credit quality of the instrument.

- Market Characteristics: Debt instruments can be classified based on the market in which they are traded. For example, government bonds and treasury securities are typically traded in the government bond market, while corporate bonds are traded in the corporate bond market. This classification helps investors identify the market dynamics, liquidity, and trading characteristics of the instrument.

Here are some common classifications of debt instruments.

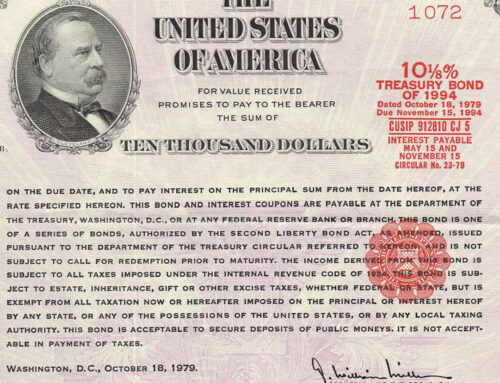

- Government Bonds: These are debt instruments issued by governments to finance their operations or fund specific projects. Government bonds are generally considered low-risk investments and are often used as a benchmark for interest rates in the market.

- Corporate Bonds: Corporate bonds are debt instruments issued by corporations to raise capital. They typically offer higher yields compared to government bonds but also carry a higher level of risk. Corporate bonds are usually rated by credit rating agencies based on the issuer’s creditworthiness.

- Municipal Bonds: Municipal bonds are debt instruments issued by state and local governments or their agencies to finance public infrastructure projects such as schools, hospitals, or highways. They are generally exempt from federal income tax and, in some cases, state and local taxes.

- Treasury Bills (T-bills): T-bills are short-term debt instruments issued by the government with maturities of less than one year. They are considered to be very low-risk investments and are often used by investors as a haven during periods of market volatility.

- Treasury Notes and Bonds: Treasury notes and bonds are longer-term debt instruments issued by the government with maturities ranging from two to thirty years. They pay periodic interest to bondholders and are considered relatively safe investments.

- Commercial Paper: Commercial paper is a short-term debt instrument issued by corporations to meet their short-term financing needs. It typically has a maturity of less than 270 days and is often used to fund day-to-day operations.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks and other financial institutions. They have fixed terms and fixed interest rates, making them a relatively safe investment option. Early withdrawal of funds from a CD may result in penalties.

- Mortgage-Backed Securities (MBS): MBS are debt instruments that represent an ownership interest in a pool of mortgage loans. They are created when banks and other financial institutions package individual mortgages together and sell them to investors.

- Collateralized Debt Obligations (CDOs): CDOs are complex debt instruments that pool together various types of debt, such as mortgages, bonds, or loans, and issue different tranches of securities with varying levels of risk and return.

- Asset-Backed Securities (ABS): ABS are debt instruments that are backed by a pool of financial assets, such as auto loans, credit card receivables, or student loans. The cash flows from the underlying assets are used to make interest and principal payments to the investors.

- Convertible Bonds: Convertible bonds are debt instruments that can be converted into a predetermined number of the issuer’s common stock at the bondholder’s option. They offer the potential for capital appreciation if the stock price increases but also provide the downside protection of a fixed-income investment.

- Zero-Coupon Bonds: Zero-coupon bonds are debt instruments that do not pay periodic interest payments. Instead, they are issued at a discount to their face value and redeemed at par upon maturity, with the difference representing the interest earned. The interest is effectively accrued and compounded over the bond’s term.

- Floating Rate Notes (FRNs): FRNs are debt instruments that have variable interest rates tied to a reference benchmark, such as LIBOR or a government bond yield. The interest rate is periodically reset based on changes in the benchmark rate, providing protection against interest rate fluctuations.

- Callable Bonds: Callable bonds are debt instruments that give the issuer the right to redeem or “call” the bonds before their maturity date. This allows the issuer to refinance debt if interest rates decline, but it may result in early repayment for the bondholder, potentially at a disadvantageous time.

- Perpetual Bonds: Perpetual bonds are debt instruments that have no fixed maturity date. They pay periodic interest indefinitely, and the principal is not repaid unless a specified event occurs, such as the issuer’s call option or a regulatory trigger.

- Junk Bonds: Junk bonds, also known as high-yield bonds, are debt instruments that are issued by entities with lower credit ratings. They offer higher yields to compensate investors for the increased risk of default.

- Sukuk: Sukuk are Islamic debt instruments that comply with Islamic principles, prohibiting the payment or receipt of interest (riba). Instead, they represent ownership in an underlying asset or project and generate returns through profit-sharing or rental income.

- Revolving Credit Facilities: Revolving credit facilities are debt instruments that provide a line of credit to borrowers. The borrower can draw funds as needed, repay the borrowed amount, and redraw funds up to a predetermined limit.