Banking is different from Manufacturing. The reasons are many. Out of one is Raw material and Final output in Manufacturing is different for Manufacturing, but in the Bank, it’s identical. So when deciding efficiency, the Ratio is different. But when talking about the banking business, it is different.

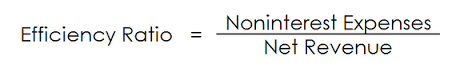

There is no Topline in Bank, but there is a Loan book. For that Loan book, the Bank is lending Money either through debentures, Savings accounts, or deposits from its account holders. So maybe it’s possible to calculate operating profit for the Bank, but that is not right if we choose the same Formula used in the manufacturing business. So to decide whether Bank is efficient or Not, We need to check noninterest expenses. There are many from payment of Employees, light bills, rent, etc. The question is how much is the part of them in Total Expenditure. Generally, you will not see a big difference all of sudden, but heavy expansion plans may affect it as not always branches are owned by banks. There are more expenses like maintaining ATM, payment for the Website, and applications if any. Yes, they are helping in Making Money but also costs There.

In simple words, the Ratio explains for earning ₹1 how much the Bank is spending. Lower the better.

When you realize the importance and meaning of the Ratio, you Will realize Why banks are trying everything to make FEE-BASED INCOME.

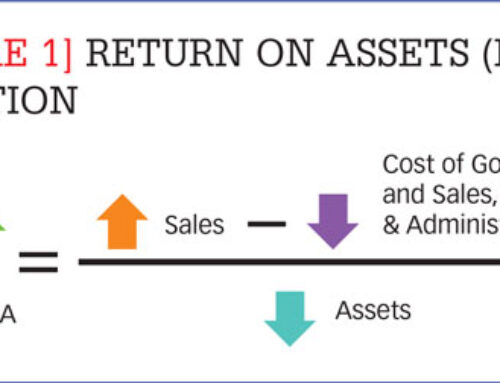

That Income is generated from a Mutual fund company, insurance subsidiary, Fee from advisory, Capital Market operations, and the Fee earned from Them, the dividend declared from a company in which Bank is keeping a Stake. All of them are increasing Revenues. As the Bank balance sheet is hugely leveraged, a Slight change in ROA will make a big difference in earnings.

Going end by saying

Choose the stock wisely as sometimes there is no use in keeping costs low if there is no Demand growth.