All assets are not fixed assets. However, some intangible assets like goodwill, patents, and copyrights, and Some liquid assets like Cash Balance, Bank Balance, Debtors, and Prepaid Expenses play a different role when analyzing a company.

A fixed asset is a long-term tangible piece of property that a firm owns and uses in its operations to generate income. Fixed assets are not expected to be consumed or converted into cash within a year. Fixed assets are property, plant, and equipment (PP&E).

Fixed assets are something that makes the company unique. Other assets may be the same, but the PPE will always make the company special. Like Shree Cement and Ultratech Cement, both are a leader in the cement industry but for different reasons. Shree Cement is a low-cost manufacturer. Ultratech is a leader in the capacity term. Like 100+ million tonnes. It’s their PPE that is making them different. While talking about fixed asset turnover, it is impossible to ignore such a thing.

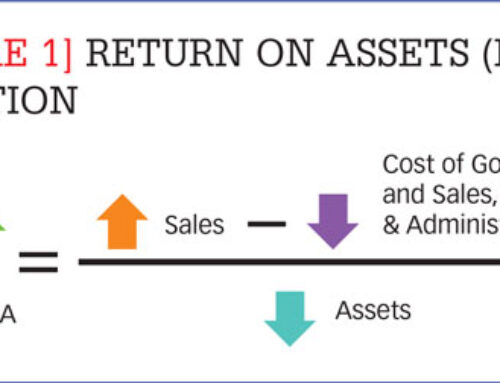

But Fixed Asset Turnover is not all about fixed assets. The formula of the ratio is

Revenue / Net Fixed Asset

Revenue is increasing. ( well, that is what was expected ) but due to depreciation, assets are decreasing. So if the company is not continuously developing or acquiring assets, the ratio will start increasing. A high ratio means that there are old assets depreciated and not replaced. A low ratio means the company is failed to utilize assets. The revenue is down.

There are some industries where this ratio is useless, like banking and the service sector. Unfortunately, there is no standard for this ratio, but you can compare it with the industry or the trend in the company itself.