Recently Two Infrastructure Investment funds list on the Indian markets. During that time, I found that many people were unaware of this and still investing in Listing gain. Though IRB infrastructure investment trust listed with good growth, the number was small in front of Equity gain. Media anchors and so-called experts started calling it a failure.

On the other hand, Foreign investors, specifically FIIs, are bullish on India. Not only in equity but in Debt.

Feb 2017 FII net debt purchase ~10600 cr..Jun 17 MTD ~5300 cr in just 4 working days..Case of FIIs more confident than DIIs on India rates?

— Lakshmi Iyer (@Lakshmi1876) June 7, 2017

Hmm. So what is debt or Fixed Income?

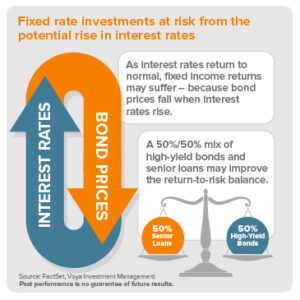

Fixed income is a Large Segment of the asset class in which Debt is one part as Asset-backed securities also come into fixed income. It is a massive market than equity as Unlisted companies, governments, different types of corporate entities, and sometimes individuals can also raise funds. In Equity, you have a claim on residual earnings. Here the lender, the entity giving money, is holding right even before the tax in many countries. The main difference between Fixed income and Equity is that you are not the business owner. You have the right to the amount that should come to you. Most of the time, it is interesting. But the investors in fixed income may gain through Accrued interest also. That is, you buy a bond for $ 500 sold it for $700, and your holding period yield is 200/500 = 40% assuming you don’t receive any coupon payment.

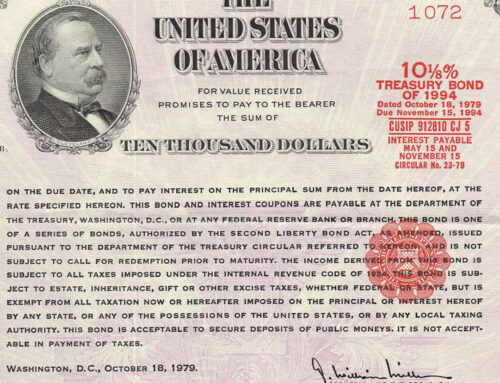

A simple Bond, the most basic Fixed income security, is like a legal agreement between Buyer and Seller. We call them Lender and Borrower, respectively. The essential features of a bond are Maturity, Issuer, par value, currency denomination, coupon rate, and the frequency of coupon payment. Most of the time, legal and regulatory considerations also play a crucial role, like in US Bond from Freddie Mac, Fannie Mae, and India IIFCL, NAHI. Govt Bond is highly rated. So the coupon payment on them will be below. But Bond from Say, HDFC Listed on London Exchange will be different.

There are many different issuers, but all come under six categories.

Supranational Like World Bank, IMF, or some other entity that is not under one govt. Very few but strong. Your money is in safe hands. Either they will issue a new bond or pay with some other funding. A sovereign bond is a bond issued by govt of a country. Maybe ad hoc or for For specific purpose. Some of them are used to determine Risk-free rates. No need to say that there is zero Default. Like bonds issued by US Govt, the Japanese Govt, and India. Another category is nonsovereign. All state govt and municipal corporations come under it. Most of the time, they are backed by the country’s Central Bank. Again. Low risk generally, but you need to check for what it will be used. If municipal corporations are raising for the water treatment plant, they can increase taxation and repay bonds. Quasi Sovereign bond is the next category. An example is Freddie Mac, Fannie Mae, and Ginnie Mae in the US. NTPC, NHPC in India. They are not issued by govt, but if needed, govt may take responsibility. Again, credit rating is important—lower default risk than corporate but nearly zero default. I mean, why Fannie Mae or NTPC will default?

Other issues are either corporate entities or unique purpose entities. Financial issuers and Non-Financial Issuers are further classified into these categories. Here credit rating and the market price is essential.

Par Value, Face Value, Redemption Value, Maturity Value, and Principal Value is the amount you will receive at the end of time on the maturity date mentioned on the bond indenture. Most of the time, it’s a round figure. Like $1000

The coupon rate is the amount you will receive on scheduled dates. Most of the time, it is in the percentage mentioned on Indenture. So you may see a $1000 FV, 6% Semiannual, 10-year bond maturing 2021. It means that you will receive $30 on a pre-decide date every six months, and on maturity, you will receive $1030. Of course, some bonds are without maturity, or the date is so long that they will not mature in your lifetime. Like maturity date is 2175, 17 September. But still, you will receive coupon payments. You may call them perpetual bonds. They are like Equity with Fixed costs.

Some bonds don’t have fixed payments. Instead, they will pay some floating payments. Like CPI inflation +2%, LIBOR +3%, in such case, you know what will be the payment next time beforehand.

Some bonds will not pay you anything before maturity. Instead, you will receive the full payment at maturity. They are called Zero-coupon bonds, and the return earned on them is accrued over time, just like capital gain on equity.