Why not start with my own experience?

Tata Chemicals. One of my First-day stocks. After I bought it, It went low as 15%. Yes, that was painful for me. But I was ignoring it. After some days, I sold it for some reason. Profitability? 30%.

Sun Life sciences. So much exciting stock once. But, yes, I was also trapped in that. Bought it around the wrong price. Outcome? One of the most considerable losses in my portfolio.

It happened because of volatility and my wrong understanding of it. But it is not an issue. This is because so many people understand it wrong.

The reason is volatility.

First, we need to understand that there is no up and down in Deposit for individuals. It is all like characteristics of Equity investment.

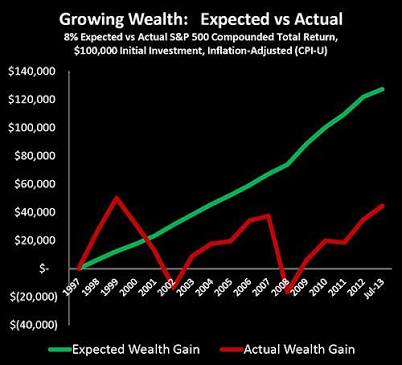

When many people start investing, they start with so many expectations. Most of the time, expectations are sky-high. Like 30% per annum. Impossible to get. Maybe some Startups will give you that type of return but not always. To achieve high returns, you need to take more significant risks.

On the other hand, the Asset classes in which you are investing also play a key role in volatility.

Let’s say you invest in Large Cap stocks—with low volatility. Yes, there is volatility but Low. Low return. The reason is Most of the Large Cap stocks are widely tracked. So many institutions also hold them in Their portfolio.

When you choose another Asset class like Small or medium Cap Equity, the price variation is high. So it’s not impossible to see that one day the stock is Best performing among the Peer and the next day, having a Lower circuit. But the attraction for them is that the company here has great potential and may make considerable wealth for investors. But most of the time hurdle is not many Brokerage Houses are tracking one stock. Some don’t even Have any coverage. Also, there was a time when the market assumed small and midcap stores to be Gambling. That also makes it volatile.

One more reason for the volatility is that even though there is a company behind every stock, investors’ ignorance often makes it attractive. All because of it, many Investors run to buy it. In some cases, the stock will perform so well that it will go out of its earning performance. That attracts some other traders to sell or go short on it.

If it’s your early time in the market, you are confused about it.

So how to handle all ups and downs?

The first lesson was Be the BOOKISH INVESTOR. Study the Asset class and the company totally before investing. There is always the possibility that a 10% downside risk is open with some stocks. If it’s impossible for you to study, give that work to a professional. Invest through Mutual funds.

Some stocks are cyclical. They are good wealth creators, But only if you understand Them.

The second thing in the Equity market is that it is not the place for you if you don’t have an income source other than this.

An essential way is to invest in a portfolio or switch off all the news channels, Newspapers.

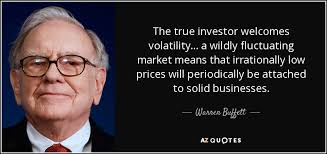

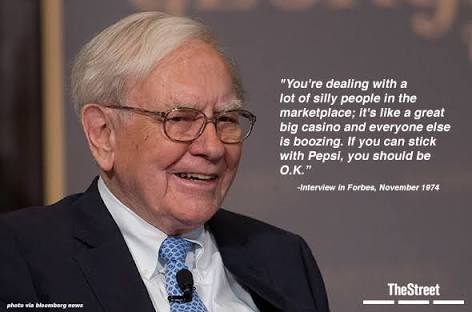

Finally going to end with some statements from Warren Buffett