Making wealth is essential, but Protecting wealth is also significant.

Hedging is significant when you are investing. As Volatility is the essential identity of Equity markets, let it be Equity, debt, or commodity, It’s always there. Using Volatility for your good and hedging against risk is what Investing is all about. But Volatility is not the only risk. There is a more significant risk that exists in the world.

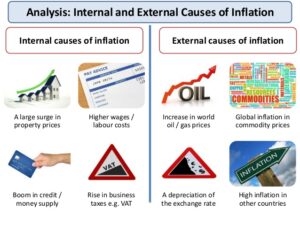

Inflation is one out of it. Inflation, in simple words, means a general increase in price and a fall in purchasing power of money. Keeping your money safe against Inflation is very important. Let it be investing or available day-to-day life. So how to tackle Inflation? Is gold the right way?

I don’t think so. Because when I was writing about gold in the past, I didn’t find such proof. You may read my post about gold.

So what are the ways to protect your portfolio against Inflation?

Interestingly, Fidelity investment Back-Tested nine assets for keeping your portfolio against Inflation, and the results are sufficiently shocking.

Let us see what they are and how they perform in history. WITH DISCLOSURE THAT PAST PERFORMANCE IS NOT GUARANTEED IN THE FUTURE.

9. Gold: Only outperforms Inflation (CPI) by 54%. Not attractive. Still, if you want to invest in gold, You may use Gold bonds and Gold ETF. ( $GLD )

8. Commodity: No, I am not surprised. During My CFA Days, I learned that commodities, most time, are hedged. As per the study of fidelity, 66% were successful. ( $GSG )

7. 60/40 Equity / Debt Portfolio : 69% outperform Inflation. Good strategy. But again, the question is, Which stock? Because some stocks like Holding a huge pile of debt on the balance sheet are useless. A Pile of cash and management, which is not investing it, is also useless. The next question is What type of debt. Sovereign, Quasi sovereign, Private? Because everyone has different characteristics. What about the Correlation of return? What about risk as to the movement of private debt came into the picture? There is some amount of risk attached. There is a way for this. In India, we have balanced funds, and in the US, If I am not wrong, DFA Global Allocation fund is the right way to invest. ( $DGSIX )

6. REIT or Real Estate Equity: Also outperform Inflation by 69%. What are they? I wrote about the structure and not specific REITs on my BLOGPOST about Yieldco. In short, REITs are companies holding assets like Real Estate, Infrastructure. They are like Mutual funds. Just not holding stocks and Physical assets. The best thing is expense ratio is very low. Though they are not available in India in us, they are available. ( ( $VNQ )

5. Broad Market Equity Index: S&P 500, S&P BSE SENSEX, NIFTY. Interestingly REIT and index are nearly similar. Index outperformed 70%, Breaking the myth that Alternative investments are negatively correlated with equity. It’s straightforward to invest in an Index. Vanguard Funds or S&P 500 are the best way in the US. India also we have Index funds. ($SPY )

4. Real Estate Income: Outperformed 71% time CPI. The question is, How do you invest? In the US, it’s not complicated. Market Vectors Mortgage REIT Income ETF. If you have risk capacity or already have a source, you don’t need to search index or managed funds. In India, we don’t have such funds. You are supposed to invest in Real Estate.

3. Barclays Aggregate bond Index: Formerly known as Lehman bond index. 75% times outperform. It’s a market capitalization-based index meaning the securities included in the index are based on their Market capitalization. The index represents nearly all types of protection. Municipal Bonds and Treasury Inflation-protected Securities are excluded as a tax treatment issue. it includes treasury securities, Govt Agency Bonds, Mortgage-Backed Securities, Corporate Bonds, and Foreign Bonds Traded in the US. iShare Core US core Bond ETF track it. In India, we have Debt funds, But in such cases, investors need to check what rating is associated with, who the issuer is, whether liquidity is sufficient, etc.

2. Leveraged Loans: What are leveraged loans? In short, would you lend them money if Bharti Airtel asked for loans from you? In short, lending money to the borrower who is already under considerable debt. High-risk High return for the portfolio, which is well diversified. It is not for you—a retail investor. But if there is a fund available specifically for it, then yes. In India, we don’t have such a concept. NPA for banks is a huge problem. But you may invest in Companies having ARC businesses. Namely Edelweiss. In the US Powershare, Senior loan ETF is the right thing for it. 79% time outperformance to CPI but come with sufficient risk.

1. TIPS: Treasury Inflation-Protected securities. In India, we call them Inflation Index Bond or Capital Index Bond, protecting principal and interest. 80% time-out performance for CPI. In the US TIP, ETFs are famous. Many of them track the Barclays TIP index.

In India, you may buy Guilt securities directly from a bank or invest in G-Sec funds. Banks like SBI give actual returns against Inflation to their Customers investing in fixed deposit products. Very simple to support and keep in your portfolio