Why this topic?

The reasons are many. What is the right way foto make retirement provisions may be subject to a big fight. But I am asking it as a simple question. If you are aware of it, you may know that it is a very big thing and as nowadays Defined contribution plans are infamous t, Employees should take all the risk for it and invest. So it is a crucial thing to concentrate on your financial planning.

on the other hand, where Mutual Funds are famous for simplicity, easy liquidity, and much more things, and if you are in the US, then it is very much possible that you are invested in Vanguard and their Retirement special fund. Though explaining the mechanism of the Vanguard retirement fund is not for what I am here, BuItill, ant to make sure that I loved it.

But what about others? Fidelity? yes, they also have good funds for retirement.

In India, investing in the capital market itself is a difficult thing. Equity is very outside till recent time. But all due to Mutual funds, it is changing. We have some retirement funds but they are not large in size. The reason is maybe still today we have something called Employee Provident Fund Organization and National Pension Scheme.

so I was on a search. As the generation is changing, is the need for retirement planning is also changing? Of course yes. So are Mutual funds the answer for it? or will they?

I found some Names of retirement funds. They are Franklin India Pension Fund (FIPF), UTI Retirement Benefit Pension Fund (UTI RBPF), Reliance Retirement Fund (RRF), HDFC Retirement Savings Fund (HDFC RSF). As mentioned earlier there are EPFO which is govt organization for the management of pension of Govt employee. Then there is National Pension Scheme. Only UTI Retirement Benefit Pension fund is holding sufficient large AUM. When checked Portfolio, More than 30% is invested in debt. Most of them are NCDs of well-known Companies. in the name of Equity it’s only companies which are broad index like ICICI bank. around 10% is cash.12% in last 5 Years. Not bad, but many others have harmful restrictions like more years lock-in period. and some make exit load if you withdraw before 58 or 60 years. NPS restricts your equity exposure to 50%, with mutual fund products such as the HDFC RSF, you can take a 100% equity exposure. Though you can invest 100% equity, personally I believe that keeping 100% equity on such types of investments is not right. As being Mutual Funds and having near,y 10% cash, Mutual funds’ pension products also offer greater liquidity, compared with the NPS or products from insurance companies. But when you know that X% of your investors are in the age which permits you to take more risk why not invest in fraction part in an illiquid asset. Retirement funds are more or less like ELSS funds. Having lock in for three years only. while searching on this, I found one very important statement from Manoj Nagpal, CEO of Outlook Asia Capital.

Since ELSS, with a lower lock-in period of three years, is available, why go for a scheme with a higher lock-in period and also a 1% exit load, if redeemed before the age of 60.

I agree with Manoj Nagpal. pension products are not products where you keep exit load. In fact, I believe that why Retirement Funds? and Why not Balanced funds or ULIP aka Unit Linked Insurance Plan.

Why? Balanced funds are taking care of the asset allocation. Like in a retirement plan. What is important in a retirement plan is to make sufficient wealth and to protect it. Though balanced funds may be lag behind in making wealth, protecting wealth is what they know best about. So making SIP, aka Dollar Cost Averaging, in some well-performing Balanced funds is the right option.

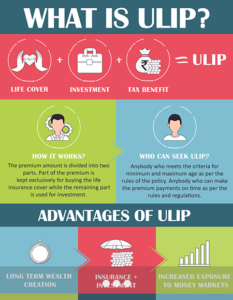

Why ULIP? Because they are a hybrid of Insurance and Mutual Fund. The best thing is You can Shift from debt and equity funds whenever you want. Plus There are insurance plans in it. In fact, we know them as the cheapest insurance plans.

But Finally, I am agreed on One thing and that is

YOU CANT GENERALISE PERSONAL FINANCE. IT IS NOT SOMETHING THAT YOU COOKED ONE DISH FOR ONE NIGHT AND SERVED TO ALL CUSTOMERS IN THE HOTEL.

But still, Mutual Funds are good for keeping some funds for retirement in your personal finance and you can’t ignore them.