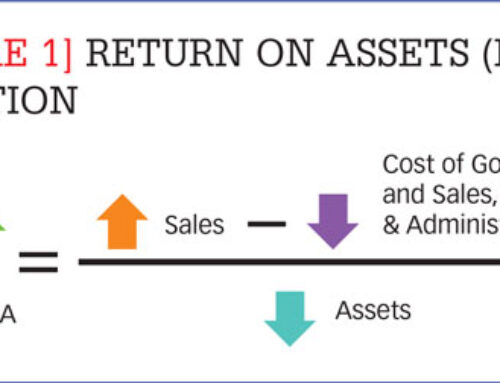

The company is doing its day-to-day commercial activities. Through this, it is making a profit. There are many ways to check profitability. Gross Profit, Net Profit, Operating profit, etc. It tells us that the company is making sufficient money to cover its costs. It is making wealth for the owners or shareholders.

But what if the company is only making a profit visible on the balance sheet? Will you invest? The answer is not straightforward. First, we need to check what the company is doing with that profit.

Some businesses are capital intensive, like infrastructure, insurance, Aviation, Mining, and Real Estate. If the company operates in such a sector, it needs to invest heady capital. On the other hand, if the company is a startup, it also needs to keep money with it to invest in a business.

But what if the company is operating in the service sector like IT? Yes, they also need money but not that big. Not all segments of Service are promising, but some are money-making.

What they are doing with the money. In fact, what should they do with it? If there is an excellent opportunity available, then invest. But what if there is no ample opportunity?

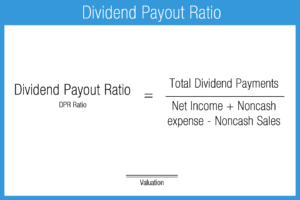

Giving Dividends or buyback is the right choice. Even though most of the time, it is assumed as a DIVIDEND Payout but it can be buyback also.

Suppose the company keeps this ratio constantly the same or maybe increases a little bit. It is a good sign. If the company is a holding company, investment company, or asset-light company, it may show you a very high Dividend Payout. For example, ITC, an Indian Company operating from tobacco to paper and hotels to IT, is leading a high Dividend Payout.

There are some companies where management and shareholders act like children and parents. One wants an immediate reward, and one is trying to deny it. Of course, there is nothing to keep earning, but what if that is the best way?

Peter Lynch, One of the best fund managers, writes in his book One up on Wall Street.

If a company has faith in its own future then why shouldn’t it invest in itself. Just as any shareholders do?… Exxon has been buying in shares because it’s cheaper then drilling for oil. It might cost Exxon $6 a barrel to find new oil, but if each of its shares represents $3 a barrel in oil assets, then retiring shares has the same effect as discovering $3 oil on the floor of NYSE.

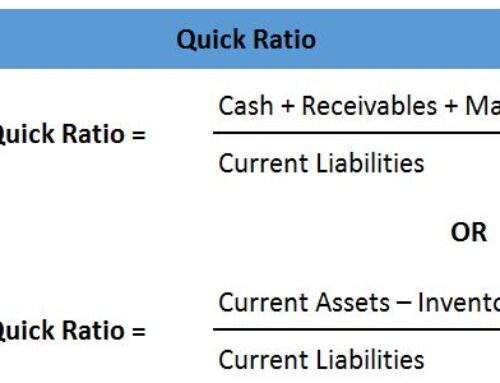

Let’s check if the company denied paying the Dividend; what are other options in front of them.

- Keep the money in the bank. Show big bank balance. Looks good. But why is management losing the opportunity to make money? Are interest rates negative?

- Investment for growth. Good. But there are some exemptions for it. There is some sector which is not growing with speed. The demand is not increasing by a significant figure like oil companies. Yes, they are growing, but how can they grow double in one or two years? Same with electricity companies or Cement companies or Car companies. Don’t tell me there is Tesla.

- In technology companies or some pharmaceutical, there is always a need to invent something new. But what about 3M, Gillette, Unilever, or Nestle, for that matter?

Sometimes Giving Dividends is the right choice.