A fixed-income index is a type of financial index that tracks the performance of a specific group of fixed-income securities. Fixed-income securities are debt instruments that pay a fixed interest rate over a specified period. Examples of fixed-income securities include bonds, notes, and treasury bills.

Fixed income indices are used by investors to track the performance of the fixed income market, to compare the performance of different fixed income securities, and to create investment strategies. Fund managers also use them as benchmarks for their investment performance.

Fixed income indices.

There are many different fixed-income indices, each with its specific inclusion criteria. Some of the most popular fixed-income indices include:

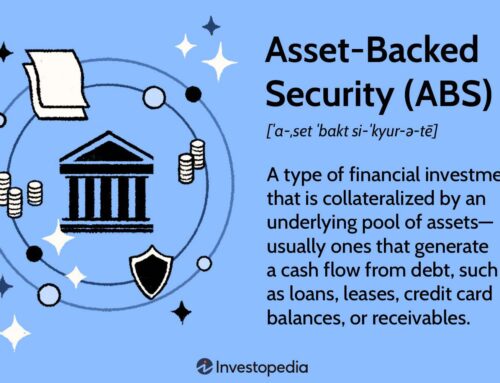

- The Bloomberg Barclays Global Aggregate Bond Index: This index tracks the performance of investment-grade bonds issued by governments and corporations around the world. The index includes government Treasury securities, corporate bonds, mortgage-backed securities (MBS), asset-backed securities (ABS), and munis to simulate the universe of bonds in the market. The index returned an average annual return of 3.22% between September 2011 and July 2023.

- The US Treasury 10-Year Constant Maturity Index: This index tracks the performance of US Treasury bonds with a maturity of 10 years. As the name suggests it is an index of US treasury index of 10-year securities.

- The S&P 500 Corporate Bond Index: This index tracks the performance of investment-grade corporate bonds issued by companies in the S&P 500 index. Investment criteria for this index are The lowest credit rating for index inclusion must be BBB-/Baa3/BBB-. S&P 500 High Yield Corporate Bond Index The lowest credit rating for index inclusion must fall on or between BB+/Ba1/BB+ and C/Ca/C

- The MSCI Emerging Markets Bond Index: This index tracks the performance of investment-grade bonds issued by governments and corporations in emerging markets.

Importance of fixed income indices

Fixed income indices are important for many different reasons. Fixed-income indices provide a way to measure the overall performance of the fixed-income market. This can be useful for investors who want to see how their investments are performing relative to the market as a whole.

Like equity Index, Fixed-income indices can be used to compare the performance of different types of fixed-income securities, such as government bonds, corporate bonds, and municipal bonds. This can be helpful for investors who are trying to decide which type of fixed-income security is right for them.

Equity or fixed income, indices give the level of risk. so they can give many different strategies for different risk profile people. Fund managers often use fixed-income indices as benchmarks for their investment performance. This means that they compare the performance of their funds to the performance of the index. This can be helpful for investors who want to see how their fund manager is performing relative to the market as a whole.

The performance of fixed-income indices can be affected by several factors, including:

- Interest rates: Interest rates are the most important factor affecting the performance of fixed-income securities. When interest rates rise, the prices of fixed-income securities fall, and vice versa. This is because the value of a fixed-income security is inversely proportional to its yield. For example, if a bond has a yield of 5% and interest rates rise to 6%, the price of the bond will fall.

- Inflation: Inflation is the rate at which prices for goods and services are rising. When inflation rises, the purchasing power of fixed-income payments falls. This is because the fixed income payments are made in nominal terms, which means that they are not adjusted for inflation.

- Economic growth: Economic growth can have a positive or negative impact on the performance of fixed-income securities. When economic growth is strong, corporate profits and tax revenues for governments tend to increase. This can lead to higher interest rates, which can put downward pressure on the prices of fixed-income securities. However, strong economic growth can also lead to higher demand for fixed-income securities, which can offset the impact of higher interest rates.

- Credit risk: Credit risk is the risk that a borrower will default on its debt obligations. The higher the credit risk of a security, the lower its price will be. This is because investors demand a higher yield to compensate them for the risk of default.

- Liquidity: Liquidity is the ease with which a security can be bought and sold. The more liquid a security, the less its price will be affected by changes in supply and demand. Illiquid fixed-income securities can be more volatile than those that are liquid.

- Geopolitical events: Geopolitical events, such as wars, can also affect the performance of fixed-income indices. This is because they can lead to uncertainty and volatility in the financial markets.