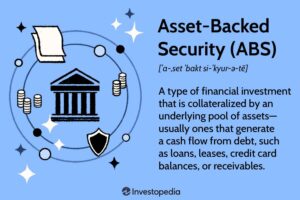

In the vast world of finance, various innovative instruments have emerged to meet the diverse needs of investors and issuers alike. One such powerful tool is Asset-Backed Securities (ABS). With their ability to transform illiquid assets into tradable instruments, ABS has revolutionized the financial markets. In this blog post, we will delve into the realm of Asset-Backed Securities, exploring what they are, how they work, and the different types that exist in the market.

What are Asset-Backed Securities (ABS)?

Asset-Backed Securities are financial instruments that are backed by a pool of assets. These assets can be anything of value with predictable cash flows, such as mortgages, auto loans, credit card receivables, student loans, and more. The primary purpose of creating ABS is to transform these often illiquid and heterogeneous assets into tradable securities, providing issuers an alternative funding source while offering investors a diversified investment opportunity.

How do Asset-Backed Securities Work?

The process of creating Asset-Backed Securities involves several key steps:

- Asset Origination: The first step is the origination of the underlying assets. For example, in the case of mortgage-backed securities, banks or lenders issue mortgages to borrowers.

- Pooling of Assets: The next step is pooling similar assets together to create a more extensive and diversified portfolio. This pool forms the collateral for the ABS.

- Special Purpose Vehicle (SPV) Formation: To isolate the pooled assets from the issuer’s balance sheet, a Special Purpose Vehicle (SPV) or Special Purpose Entity (SPE) is created. The SPV buys the pooled assets from the issuer and issues ABS to investors.

- Tranching: The pool of assets is divided into different tranches based on their risk and return profiles. Each tranche represents a distinct level of seniority in the cash flow structure. The senior tranches have priority in receiving cash flows, while the junior tranches are riskier but offer potentially higher returns.

- Credit Enhancement: To enhance the credit quality of the ABS and attract investors, credit enhancements like over-collateralization, cash reserves, and insurance are often employed. These mechanisms provide additional protection to investors in case of default on the underlying assets.

- Issuance and Trading: Once the ABS is created, it is offered to investors through the financial markets. The ABS can be traded on secondary markets, providing investors with liquidity.

What are the different types of Asset-Backed Securities available in the market?

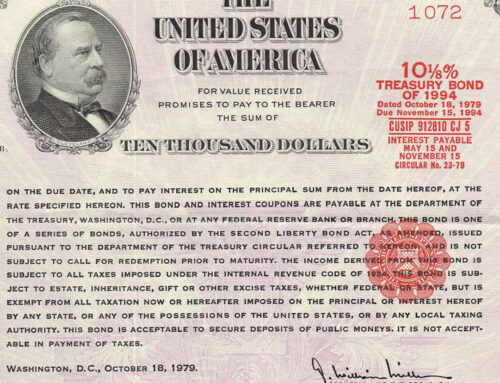

- Mortgage-Backed Securities (MBS): One of the most well-known types of ABS is Mortgage-Backed Securities. MBS are backed by a pool of residential or commercial mortgages. The cash flows generated from the monthly mortgage payments form the basis for interest and principal fees to the MBS holders.

- Auto Loan-Backed Securities: Auto Loan-Backed Securities are backed by a pool of auto loans. These loans are typically originated by banks, credit unions, or auto finance companies. Similar to MBS, the cash flows from the borrowers’ monthly payments serve as the source of payment to investors.

- Credit Card-Backed Securities: Credit Card-Backed Securities are backed by a pool of credit card receivables. When individuals make purchases using their credit cards, they accrue a balance. The cash flows from the interest and principal payments on these balances are used to pay ABS investors.

- Student Loan-Backed Securities: Student Loan-Backed Securities are backed by a pool of student loans. These loans are often originated by the government or private lenders. The cash flows generated from the borrowers’ loan payments form the basis for interest and principal payments to ABS holders.

- Collateralized Debt Obligations (CDOs): CDOs are a more complex form of ABS. They are backed by a diverse pool of assets, including MBS, corporate bonds, and other ABS. CDOs are structured into different tranches with varying levels of risk and return.

- Commercial Mortgage-Backed Securities (CMBS): CMBS are backed by a pool of commercial mortgages, typically on office buildings, retail centers, hotels, and other commercial properties. The cash flows from the commercial property tenants’ lease payments are used to make payments to CMBS investors.

- Equipment-Backed Securities: Equipment-Backed Securities are backed by a pool of equipment leases or loans, such as machinery, aircraft, or industrial equipment. The cash flows from the lease or loan payments serve as the basis for interest and principal payments to ABS holders.

What are the risks in Asset-backed securities?

To understand this, you need to understand some basic concepts. Contraction risk is a type of risk faced by holders of fixed-income securities. It refers to the risk that the debtor might pay back the money borrowed more quickly than anticipated, thereby reducing the amount of future interest income received by the security holder.

This type of risk increases as interest rates decline. This is because declining interest rates might incentivize borrowers to prepay some or all of their outstanding debts to refinance at lower interest rates.

On the other hand, Extension risk is the possibility that borrowers will defer prepayments due to market conditions.. Extension risk is the danger that borrowers will defer prepayments due to market conditions.

Asset-Backed Securities have transformed the landscape of finance, offering benefits to both issuers and investors. They enable issuers to access alternative funding sources while diversifying their funding structure. On the other hand, investors gain access to a wide range of investment opportunities with varying risk profiles. Understanding the different types of ABS and their functioning is essential for investors and financial professionals to make informed decisions and capitalize on the potential offered by these financial powerhouses. However, like any investment, ABS carry risks, and investors should carefully analyze the underlying assets, credit enhancements, and overall market conditions before making investment choices. As financial markets continue to evolve, Asset-Backed Securities will likely remain an integral part of modern finance, providing a crucial link between the real economy and the investment world.