Bonds are essentially financial instruments that allow governments, corporations, municipalities, and international organizations to raise capital from investors. They offer a relatively stable source of income for investors and play a significant role in shaping the global financial landscape. In this blog post, we will delve into the world of bonds, exploring four major types: Sovereign Bonds, Corporate Bonds, Municipal Bonds, and Supranational Bonds

Sovereign Bonds:

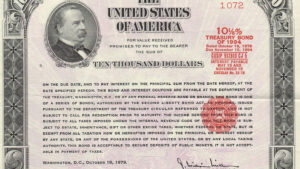

Sovereign bonds, also known as government bonds or treasuries, are issued by national governments to fund various public expenditures or bridge budget deficits. The history of those instruments includes the civil war and many other things. These bonds are considered one of the safest investments in the financial markets since they are backed by the full faith and credit of the issuing government. Countries with strong economies and stable political environments often enjoy lower interest rates on their sovereign bonds, while countries facing economic challenges may have to offer higher yields to attract investors. Interest rates on sovereign bonds can have significant effects on the global financial situation due to the interconnectedness of financial markets and the importance of government debt in the global economy.

Sovereign bond interest rates often serve as a benchmark for other interest rates in the economy. When a major sovereign issuer’s interest rates rise or fall, it can influence interest rates in other countries and affect borrowing costs for governments, corporations, and individuals worldwide. Sovereign debt is a fundamental component of the global financial system. If interest rates rise sharply or become unsustainable for a country, it can trigger financial instability, affecting global banks, investors, and financial institutions with exposures to that country’s debt.

Investing in sovereign bonds can be an integral part of a diversified investment portfolio, and they are often considered a benchmark for risk-free rates in financial markets.

Sovereign bond interest rates can be an indicator of market sentiment regarding economic growth prospects. Rising interest rates may signal expectations of stronger growth, while falling rates may indicate concerns about an economic slowdown. Sovereign bonds issued by stable and economically strong countries are often considered safe-haven assets. During times of uncertainty or market volatility, investors may flock to these bonds, causing their yields to fall, and conversely, reducing yields when confidence returns.

Corporate Bonds

Corporate bonds are issued by corporations and private companies as a means to raise capital for business operations, expansion, or debt refinancing. Unlike sovereign bonds, corporate bonds are not backed by a government but are somewhat dependent on the creditworthiness of the issuing company. Companies with higher credit ratings typically offer lower yields, as investors perceive them to be less risky.

Corporate bonds vary in terms of risk and return, with some companies being more stable and reliable, while others may carry higher risks but offer the potential for higher yields. The creditworthiness of an issuer of a corporate bond refers to the issuer’s ability to repay the bond’s principal and interest promptly. Investors and credit rating agencies assess various factors to determine the creditworthiness of a corporate bond issuer. Here I am talking about some.

- Credit rating agencies like Standard & Poor’s, Moody’s, and Fitch assign credit ratings to bond issuers based on their credit analysis. These ratings reflect the issuer’s creditworthiness, with higher ratings indicating lower credit risk.

- The stability and resilience of the issuer’s business model and its industry outlook are considered. Industries with cyclical or volatile revenue streams may be perceived as riskier.

- The issuer’s revenue and profitability trends are essential indicators of its ability to generate sufficient cash flow to service its debt.

- The maturity profile of the issuer’s existing debt is important. A balanced and well-spaced maturity schedule reduces refinancing risk.

- For some bonds, especially secured bonds, the type and value of collateral provided by the issuer play a role in determining creditworthiness. Overcolatoraliseation helps in some cases.

Municipal Bonds

Municipal bonds, often referred to as “munis,” are issued by state or local governments, cities, or other municipal entities to finance public infrastructure projects like schools, hospitals, roads, and utilities. The interest earned from municipal bonds is typically exempt from federal income taxes and may also be exempt from state and local taxes, making them attractive to investors seeking tax advantages.

Municipal bonds come in two main types: general obligation bonds, which are backed by the issuer’s taxing authority, and revenue bonds, which are supported by the revenue generated from the specific projects they finance. While municipal bonds are generally considered less risky than corporate bonds, the creditworthiness of the issuing municipality should still be carefully assessed.

Supranational Bonds:

Supranational bonds are issued by international organizations, such as the World Bank, International Monetary Fund (IMF), or regional development banks. These organizations raise funds to finance projects that promote economic development and welfare on a global or regional scale. Supranational bonds are generally considered to be low-risk investments due to the financial strength and stability of the issuing institutions, as well as the vast diversity of their portfolios.

Investing in supranational bonds allows individuals and institutions to support global initiatives and development projects while diversifying their investment holdings.

In conclusion, bonds are an integral part of the global financial system, providing opportunities for governments, corporations, municipalities, and international organizations to raise capital, while also offering investors a diverse range of risk and return profiles. As with any investment, thorough research and analysis are crucial when considering bonds as part of an investment strategy. Understanding the characteristics and risk factors associated with each type of bond can help investors make informed decisions and build a well-balanced portfolio.