Why are you buying the stock of the Company by using your hard-earned money? But, of course, you may use that money for any other reason. Like spending dinner while enjoying yourself with your family?

Because you want to earn money in the future with it.

How will you earn money?

With Dividend or Capital Appreciation.

How will that money come to you?

When the Company will earn it.

That is what Warren Buffett is trying to figure out here.

What if the Business or the operation of the Company or the Product or Service of the Company will NOT SURVIVE? Say Pager. Good product, but how big is the lifespan? Now assume if you Invested the money in any Pager company. Will that make money for you? Not really.

Some companies have been doing their Business for a long time. The product is tried and tested.

The market knows them. And they will not go out of the Business quickly. The best example here is Google. I know that Warren Buffett doesn’t like to invest in internet companies. But, if I am not wrong, Charlie Munger mentioned Moat of Google.

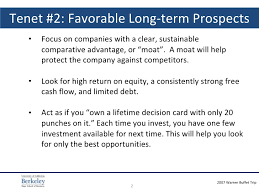

What is Moat?

In ancient times, Castle was not only Defence but also partly Citi, where people lived, so it was a soft target for the enemy. Therefore, kings and owners need to defend it. One way to do it is by digging land around the Castle and filling Water in it.

Something similar is there with Economic Moat.

A Business can maintain a competitive advantage over its competitor to protect its long-term profile and market share.

One more example may be Facebook. The way they are doing Business is essential and makes them different.

I may give you examples in India, such as Colgate Palmolive, ITC, Coal India, etc.