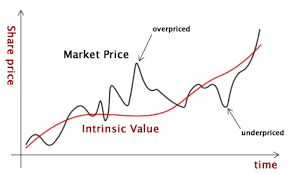

For Warren Buffett, the Intrinsic value of the business is significant. It is the core part of value investing.

A market can discount Many things, but some items are Not discounted in Price. Many times the market ignores some facts.

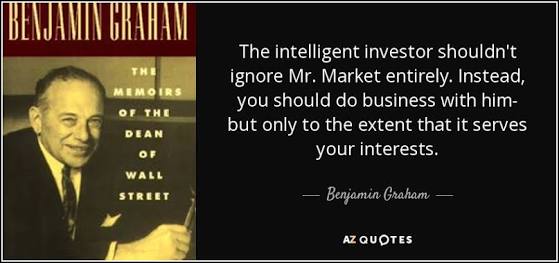

Value Investing is all, depending upon the assumption that there is Mr. Market, who sometimes is in the mood to give good business at cheap rates. But, unfortunately, sometimes it also gives away the Price, which is not the Price and is so high.

How to decide where to trade and where to ignore?

Simple. Every business is doing its Operations. While doing so, they make some value. It could be in the form of Profit, Cash, dividend and history, assets, tie-ups, patents, Goodwill, or anything else.

After accepting it, it is clear that the company’s intrinsic value is not changing daily.

I agree that the Price may differ from person to person. But there is some. The ore part of value investing is This intrinsic value. Benjamin Graham came up with Formula for That. Some people say that Warren Buffett also has Formula. Maybe. But for me, there is the more important concept.

Because what is essential is the Next tenet, and that all depends upon it.