Only 35% of Americans actually have a financial plan. Plan ahead now. (via @WealthForesight) https://t.co/0Pa5elElOl

— Investopedia (@Investopedia) June 26, 2017

There's a difference between financial planning and investing. (via @DavidRaeCFP) https://t.co/EdRjwv2DGS

— Investopedia (@Investopedia) July 7, 2017

So What is financial planning? Is it necessary at all?

Simply put, it is the process of meeting your financial goals through properly managing resources.

From starting to the end of your life, you are going from different stages of life, and your needs are different for every step. But, in all those stages, you need money to live your life. So financial planning is nothing but planning for those goals and allocating resources for them as per need.

What is a need? Inflation is significant during financial planning. The basic assumption is that the cost of your retirement today does not equal seven years or ten years after. Your challenge is to make provisions for it and protect them from losing their value. How to do that? By using the right mix of asset allocation.

Steps in Financial planning

- Calculate current funds, income, and savings. What sources do you have today, and can you use them tomorrow? Like Home.

- Set your target like buying a car. keeping sufficient amount in a Retirement fund, Long Foreign trips, etc

- Make an investment plan for it by using the proper asset allocation

- Keep emergency fund

- Monitor regularly

Generally, starting financial planning at 20-25 is better. It helps a lot, and there is no need to say that studies found. It is simple logic.

Making a budget of your income and expenditure, what are your liabilities, and from where will you earn money to service them? Like education. How are you going to Finance it? In India and many other countries, your parents pay for your education.

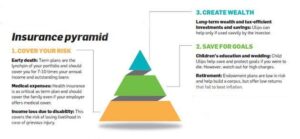

Insurance is also one crucial factor. Earlier you buy it, the better. Many types of insurance include Health Insurance, Life Insurance, Home Insurance, and Home Loan Insurance. You need to take care of it. By buying adequate insurance, you are reducing the risk taken you. I found one image from the economic times, which I think is essential when considering insurance. I am going to share it here.

Many people keep talking about investment when talking about Financial plans. However, they don’t understand that investment is a way to achieve a target, so they fall in love with the tool. It is similar to Carpenter forgetting his work and falling in love with his tolls. Why investment and return are essential in financial planning? You need to achieve Target and so manage money respectively.

Debt management is an integral part of financial planning. While studying for the post, I found that most of the time, Debt is the reason for failure in life. I don’t need to explain here. We all know what examples from our personal life, and many celebrities are. That’s why managing debt and keeping it under control is essential.

Education planning for you, your SO, and your children is not something you can avoid. Although, as we know, expense on health care is a significant portion of monthly expenditure, you are supposed to keep some money aside for it.

Who should inherit your wealth? This is a fundamental question. Because it highlights two essential factors in financial planning, one is Inheritance planning, and the second is wealth planning. Deciding the inheritance is as necessary as making wealth. So making one will is very important.

What is wealth? Valuable possessions. Wealth creation, in simple words, is Making something more than the inflation rate. For example, say that the inflation rate is 7% and your earning growth rate is 5%, then you are losing money. But if you are growing money by 15%, it’s wealth creation.

Financial Windfall management is a very ignored part of financial planning. Maybe because it is not specific and the size is also not the same. But if you want to succeed in financial planning and life, then it is essential.

Retirement planning is a very vast topic; you can write one large book on it. So many things change when you are going to retire. Even the starting point itself is significant. When should you retire? A fundamental question, and so yes. It would be best if you planned about it.

Many of these things are not the ones in which you are an expert. So it’s always best to keep one financial advisor for it. How choose one is also essential in making a financial plan.

Real estate is a significant factor. Almost everyone will accept that Home is not only an investment but something more than that. But at what age are you supposed to buy? is there any age? What about a down payment? Yes. You need professional help with it also.