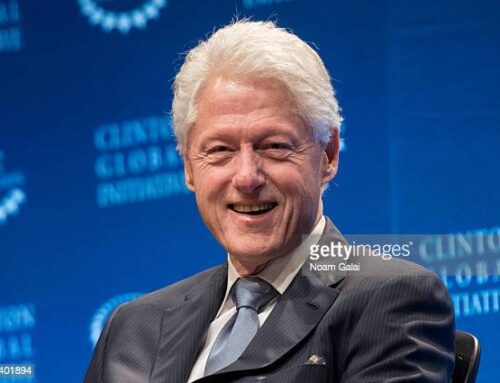

James Earl Carter Jr., better known as Jimmy Carter, was the 39th President of the United States, serving one term from 1977 to 1981. He was born on October 1, 1924, in Plains, Georgia, and grew up in a small farming community.

Before becoming President, Carter served as a naval officer, a state senator in Georgia, and the Governor of Georgia. He ran for President in 1976 and was elected in a landslide victory, defeating incumbent President Gerald Ford.

As President, Carter focused on domestic and international issues, including energy policy, human rights, and the economy. He implemented several significant reforms, including the creation of the Department of Energy and the establishment of a national energy policy. He also worked to improve relations with the Soviet Union and helped to broker the Camp David Accords, which led to peace between Israel and Egypt.

Despite these achievements, Carter faced several challenges during his presidency, including rising inflation, high energy prices, and the Iranian hostage crisis. He was defeated in his bid for re-election in 1980 by Ronald Reagan.

After leaving office, Carter has remained active in public life, focusing on issues such as human rights, conflict resolution, and global health. He has written over 30 books, including his memoirs, An Hour Before Daylight and White House Diary.

In 2002, Carter was awarded the Nobel Peace Prize for his work in promoting peace and democracy around the world. He is widely admired for his dedication to public service and his commitment to humanitarian causes.

So I mean, what to learn about finance from a president who may hold Longest living former President? Barack Obama may break that. But that’s not the subject of the post. What to learn about finance from him?

Retirement planning.

The average lifespan has increased significantly over the past century due to improvements in medical care and public health. In the United States, life expectancy at birth has increased from around 47 years in 1900 to almost 79 years in 2020. This increase in expected lifespan has essential implications for retirement planning, as people may need to save more for retirement to support themselves for a longer period. It also means that people may need to plan for the potential need for long-term care in their later years.

The increase in life expectancy has also led to changes in the way that people think about retirement. Many people now view retirement as a time to pursue new interests and activities, rather than simply a time to stop working and rest. This shift has led to the development of the concept of “retirement planning,” which involves not just financial planning, but also planning for how to make the most of one’s later years.

Jimmy Carter and many other big names like Warren Buffett, and Charlie Munger are living a life of 90 years. So the question is whether our retirement calculations are up for change. I am not against pensions, I am completely agreed with Barack Obama when he said that people earned them. But what I am highlighting is different. I am highlighting some risks.

Retirement planning involves managing a variety of risks that can impact your financial well-being during retirement. Some common risks to consider when planning for retirement include the following:

- Inflation risk: Inflation can erode the purchasing power of your savings over time, making it harder to maintain your standard of living during retirement.

- Market risk: Investments in stocks and other securities come with the risk that the value of your portfolio could decline, potentially affecting your retirement income.

- Longevity risk: The risk that you will outlive your savings and not have enough income to support yourself in your later years.

- Health care costs: Health care expenses can be a significant financial burden during retirement, especially if you develop a serious illness or need long-term care.

- Social Security risk: The financial stability of Social Security, which provides a source of income for many retirees, is uncertain and could potentially be impacted by future policy changes.

To manage these risks, it’s important to diversify your investments, save enough for retirement, and plan for potential expenses such as health care costs. It may also be helpful to work with a financial advisor to develop a retirement plan that takes these risks into account.

In India, while I am writing this, the New pension vs. the old pension is the subject of wide debate. Originally EPFO or employee provident fund organization was managing this, but now govt making this market-linked, and some people realize this is another risk added. Here I need to accept, it was largely up to govt to spend for them. as expected life started increasing, and it was a burden for govt. I don’t want to go into that deep, but what I want to say here is you need to think about all that things

Pensions are retirement plans that provide a regular income to people after they stop working. There are several types of pension plans, including defined benefit plans, defined contribution plans, and hybrid plans.

Defined benefit plans are the traditional pension model, in which an employer promises to pay a certain level of benefits to employees when they retire. These benefits are usually based on factors such as an employee’s salary and length of service. The employer funds the plan by making contributions to an investment fund, which is used to pay the benefits when they are due.

Defined contribution plans, such as 401(k) plans and individual retirement accounts (IRAs), are funded by employee and employer contributions. The benefits that an employee receives in retirement depend on the contributions made to the plan and the investment returns earned on those contributions.

Hybrid pension plans, such as cash balance plans, combine elements of both defined benefit and defined contribution plans.

Regardless of the type of pension plan, it is important for the plan to be well-funded and properly managed to provide the promised benefits to retirees. This typically involves making appropriate investments to ensure that the Pension plan has sufficient assets to pay the benefits when they are due.

Not only jimmy carter, But I can say many retired peoples are now living longer lives. So this type of risk is part of the Modern age. It is better to make our calculation by assuming that now our ages can easily go higher than 60 or in some cases 70 years also.