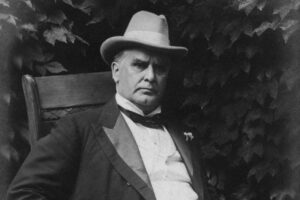

William McKinley was the 25th President of the United States, serving from 1897 to 1901. He was born in Niles, Ohio, in 1843, and grew up in a poor family. Despite this, McKinley was a bright and ambitious young man, and he worked hard to obtain a good education.

After completing his studies, McKinley became a teacher and later attended law school. He was admitted to the bar in 1867 and began practicing law in Canton, Ohio. In 1869, he was elected to the Ohio legislature, and he later served in the U.S. Congress as both a representative and a senator.

In 1897, McKinley was nominated as the Republican candidate for President, and he defeated his Democratic opponent, William Jennings Bryan, in the general election. As President, McKinley is perhaps best known for his efforts to promote American industry and expand the country’s overseas territories.

During his presidency, McKinley signed the Dingley Tariff Act, which raised tariffs on imported goods to protect American manufacturers. He also oversaw the annexation of Hawaii and the acquisition of Puerto Rico, Guam, and the Philippines as territories of the United States.

In foreign policy, McKinley played a key role in the Spanish-American War, which resulted in the defeat of Spain and the establishment of American control over Puerto Rico, Guam, and the Philippines.

Despite these accomplishments, McKinley’s presidency was cut short when he was assassinated by an anarchist in 1901. He was succeeded by his Vice President, Theodore Roosevelt. Today, McKinley is remembered as a strong and effective leader who worked to promote American industry and expand the country’s influence abroad.

If you are taking a loan, many times banks make someone cosign. I don’t know whether you think about it or not but this president was in debt of $100,000 or more than $300,000 in today’s term. But that’s not all.

William McKinley was the fifth President in 28 years who born in 28 years. As the United States was transitioning, he was the first president to travel from the automobile. He was president during the Spanish war which help the US gain significant territory. well, that was sufficient for someone. But not for him. Teddy Roosevelt was his Vice president. So yes. You guess it correctly. He was the president who got shot during his presidency. Someone perfectly said that the US president is job-holding the biggest risk. It will pay you well but also you are facing the biggest risk.

But that’s not all. He was in school when the US was facing 1857. He was a dropout from school but his family lost everything. So yes this guy was known to promote American industry, there was a reason for that. His father owned a small iron foundry and instilled in young William a strong work ethic and a respectful attitude. Wait there is more. The Building and construction of the Panama canal start when he was president. I am not shocked. Lesson learned. Your mother and father are teaching many things to you. knowing or unknowingly.

But his financial situation was not at all good. William McKinley went bankrupt while serving as Ohio’s governor in 1893. It was his friends who help him come out of that bankruptcy. Just years before being elected as President. That’s why Your tax returns are important. That is credibility and also gives an idea of who is having leverage over you.

What lesson do you learn here? Cosigning the loan also makes you vulnerable.

Cosigning is when someone (the cosigner) agrees to take on equal responsibility for paying off a loan along with the primary borrower. This is often done when the primary borrower has a limited credit history or a low credit score, and therefore may not qualify for the loan on their own. By cosigning, the cosigner is essentially vouching for the primary borrower’s ability to repay the loan, and promising to step in and make payments if the primary borrower is unable to do so.

When a person cosigns a loan, their name, income, and credit history are also considered when assessing the loan application, and the cosigner’s credit score is also considered

A cosigner is someone who helps a borrower get approved for a loan. The cosigner agrees to repay the loan if the borrower does not. A lender may require a cosigner if the borrower does not have enough income or enough credit. If the cosigner has better credit, cosigning the loan might also help lower the interest rate.

Common examples of loans that may include a cosigner include car loans, mortgages, student loans, or apartment leases.

Cosigning for someone means you’re taking responsibility for the loan, lease, or similar contract if the original borrower is unable to pay as agreed. Whatever you cosign will show up on your credit report as if the loan is yours, which, depending on your credit history, may impact your credit scores.

When you cosign a loan, you are taking on equal responsibility for the debt along with the primary borrower. This means that if the primary borrower is unable to make their loan payments, the lender will hold you responsible for paying off the debt. Additionally, if the primary borrower defaults on the loan, it will negatively impact your credit score and make it more difficult for you to obtain credit in the future. Additionally, if the primary borrower file for bankruptcy, it could lead to legal action against you.

How does being a co-signer affect my credit score? Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments. The lender can sue the cosigner for interest, late fees, and any attorney’s fees involved in the collection. If the primary borrower falls on hard times financially and cannot make payments, AND the cosigner fails to make the payments, the lender may also decide to pursue garnishment of the wages of the cosigner. Cosigning can damage the relationship between the primary borrower and the cosigner. Cosigning requires a great deal of trust that the primary borrower can afford the payments on the loan and that they will make them on time for the entire length of the loan. In some countries, If the loans are forgiven by the lender, the IRS will consider the remaining loan amount “debt forgiveness income.” This means that the cosigner will have to pay taxes on the loan amount as if the loan amount is income.

Fortunately, you can have your name removed, but you will have to take the appropriate steps depending on the cosigned loan type. You have two options: You can enable the main borrower to assume total control of the debt or you can get rid of the debt entirely.