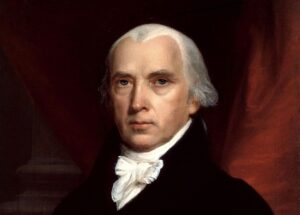

James Madison was the fourth President of the United States, serving from 1809 to 1817. He was a key figure in the early history of the United States, playing a pivotal role in the country’s struggle for independence from Great Britain and the drafting of the United States Constitution.

Madison was born in Virginia in 1751 and grew up in a wealthy family. He received a good education and became a lawyer, and in 1775, he was appointed as a delegate to the Continental Congress. In Congress, he was a vocal advocate for independence from Britain, and he played a key role in the drafting of the United States Constitution.

After the Revolutionary War, Madison returned to Virginia and continued his career as a lawyer and politician. In 1789, he was appointed as the United States’ first secretary of state, and in 1794, he became the country’s first minister to France. In 1809, he was elected as the fourth President of the United States, succeeding Thomas Jefferson.

As President, Madison faced many challenges, including tensions with Europe and a growing political divide within the United States. He also oversaw the War of 1812, in which the United States fought against Great Britain. After serving two terms, he retired from public life and returned to his home in Virginia, where he died in 1836.

Madison is remembered as one of the most important and influential figures in American history. His efforts to secure independence and his leadership as President helped to shape the country and set it on a path toward greatness. Despite the challenges he faced, he remains a towering figure in American history, and his legacy continues to inspire people around the world.

Though he was a towering figure, with 5 foot 4, he was the shortest president in height. Many people said that Presidents before Lincoln was having slavery as an Issue. After him, Human rights was becoming a new issue.

But here, We learn how the Vision of John Adams helps James Madison. John Adams set up the army and Navy. It becomes helpful for Madison. Lesson learned. So your work. Wealth can not be built in one day.

Here I found something interesting. Yes, I am a firm believer in Keynesian Economics and so it was interesting to see someone who opposes big government expenditure, turned into a supporter of it. The war convinced Madison of the necessity of a stronger federal government. He presided over the creation of the Second Bank of the United States and the enactment of the protective Tariff of 1816.

Just like other presidents of that time, he own slaves and he never freed them. His father was the biggest landowner in Virginia. Nothing shocking here. What makes me think is that the man who plays important role in the constitution and Bill of human rights can’t see Slaves. I think that is what makes Abraham Lincoln Great.

But What can be compared with Constitution about your Investment and Financial Life? The answer is the Investment Policy statement.

Well, I cansayy that if you compare his wealth in terms of Today’s wealth, he wasa billionaire. His agriculture greatly succeeded, Habit of his son was leakage for his wealth. Gambling. For this,s he had to sell off halfMontpellier’sr plantation and half of his slaves (which he was originally planning to free) need to sell for payment of Debt. Lessonlearnedt. Gambling is bad. No matter what.

I wrote one blog post about it. It didn’t receive any views sadly but as a finance student, I know how much important it is. When you have an investment policy statement, you are clear about what is important for you. You are clear about your goals. You are clear about your direction. So hiccups didn’t bother you. In the same way, when you are clear and written down the constitution, you know in what way a nation is heading. In many cases, it helps Nations to understand what is important and what is not.

An investment policy statement (IPS) is a document that outlines the goals, risk tolerance, and investment strategy of an individual or organization. It serves as a guide for making investment decisions and helps ensure that all investments align with the investor’s long-term financial goals.

Several key elements should be included in an IPS:

- Investment objectives: The IPS should outline the specific financial goals of the investor, such as saving for retirement, funding a child’s education, or generating income for a business.

- Risk tolerance: The IPS should include a discussion of the investor’s appetite for risk, as well as any constraints that may impact their ability to tolerate risk (e.g. the need for liquidity or the desire to preserve capital).

- Asset allocation: The IPS should outline the proportions of different asset classes (e.g. stocks, bonds, cash) that should be held in the portfolio. The asset allocation should be based on the investor’s goals and risk tolerance.

- Investment strategy: The IPS should describe the overall approach to investing, including any specific investment vehicles or strategies that will be used (e.g. mutual funds, individual stocks, or exchange-traded funds).

- Performance measurement: The IPS should outline how the portfolio’s performance will be monitored and how it will be compared to appropriate benchmarks.

- Review and rebalancing: The IPS should specify how often the portfolio will be reviewed and whether any rebalancing will be done to ensure that it stays aligned with the investor’s goals and risk tolerance.

Having an IPS can be particularly useful for individuals or organizations with a long-term investment horizon. It helps to ensure that investment decisions are made with a clear understanding of the investor’s financial goals and risk tolerance and that the portfolio is regularly reviewed and rebalanced as needed. By adhering to an IPS, investors can make more informed decisions and potentially achieve better long-term results.