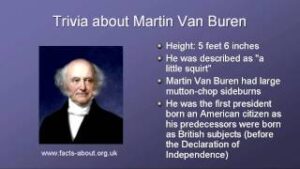

Martin Van Buren was the eighth President of the United States, serving from 1837 to 1841. He was a key figure in the early history of the United States and played a pivotal role in the development of the Democratic Party.

Van Buren was born in New York in 1782 and grew up in a poor family. He received a good education and became a lawyer, and in 1812, he was elected to the United States Senate. In 1821, he was appointed as the United States minister to Great Britain, and in 1828, he became the governor of New York.

In 1836, Van Buren was elected as the eighth President of the United States, succeeding Andrew Jackson. As President, he faced many challenges, including an economic depression and a growing political divide within the United States. He also oversaw the admission of several new states to the Union, including Arkansas, Michigan, and Florida.

After serving one term, Van Buren was defeated in the 1840 election by William Henry Harrison. He retired from public life and returned to his home in New York, where he died in 1862. Van Buren is remembered as a dedicated public servant and an important figure in the early history of the United States. Despite the challenges he faced, he remains a significant and influential figure in American politics.

So what is the thing which we can learn about finance from Him? Well, he was the First president who was born in the independent United States but still for him, English was the Second language. Offshore risks are always there even if you called yourself Independent.

What are those? Nowadays I am watching many advertisements of applications and mutual fund companies which are saying that investing in the United States market is Good. Before they attacked Ukraine, Russia opened doors for Indians for direct investment in the Moscow stock exchange. Those investments will give another asset and something to work for diversification. But Every country has its own risk. Who would have thought that the German economy is attached to Russian energy so much that it can be used as a weapon? British people voted for Brexit, but that affect them as the final deal of Brexit came very different and made their problems. Being a very big and impactful Central bank in their neighborhood, Canada many times feels like a test tube of the Federal reserve. Forget it, Political Instability was one risk if you think about Italy. Many US companies are designing Microchips and related products but a large number of them are made in Taiwan, which is not even recognized as a country. Some handful of small islands recognizes them.

As there are challengers to the dollar for its status as the reserve currency, the United States is showing its effects via Oil Export. While writing it is the biggest supplier of oil to Europe. Ukraine’s war highlighted its place in the global food market. Even if the Indian Prime minister said we can feed the world, they realise the importance of the domestic market and just stopped. China though dominates in export and manufacturing, World depends on them. and so when China locked down as per their zero covid, Without any reason, many other economies felt the heat.

A few other examples highlight what I mean here.

The Global Financial system is so connected, it is easy to raise money in one part of the global market in one currency, and use it in another currency. So it is very easy to see, one company raising funds in the United States of America, setting up a factory in China, for which Raw materials come from Indonesia, and Products were made as per the regulation of Europe. The information technology back office for that is in India but Product is used somewhere in Africa. Completely possible. So how can we say that interest rates, Foreign exchange rates, and the political situation in that economy are not affecting you?

He opposed not only the creation of a new Bank of the United States but also the placing of Government funds in state banks. He fought for the establishment of an independent treasury system to handle Government transactions. This show how visionary he was. Realising that government finance is big thing and to manage it is supposed to be completely up to government. In the early 19th century, Americans were routinely jailed for being unable to repay loans. Van Buren and other reformers, however, argued that debtors’ prisons were not only unfair, but counterproductive, making it less likely the debtors would get back on their feet. If debtor will be in jail, how can he repay debt? also how that can help debtor in his life Such punishment largely disappeared before the Civil War, but a debate continues over how much personal responsibility individuals should bear for their financial misfortunes. Academic studies—including ones written by now-Senator Elizabeth Warren—that blame big medical bills for many modern bankruptcies are a frequently cited argument in favor of the Affordable Care Act.

As he was president before civil war, his views are interesting about slavery. “Morally and politically speaking slavery is a moral evil.” The statement by Van Buren shows he considered the practice of enslavement immoral and wicked, but it is a “moral evil” he benefited from both personally and professionally. As first and third president were slav owner, i am not shocked that he was benefitted from it. But knowing that he acknowledge it as moral bad, but still didn’t do anythingbagainst it? Here I started respecting James madison and james Monroe. So when i realise thatbhe was also an lawyer, its sad to see it.