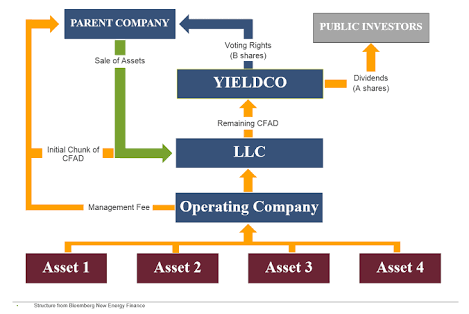

Yieldco is publicly traded a dividend growth-oriented company created by a parent company (e.g., Sun Edison) that bundles renewable and conventional long-term contracted operating assets to generate predictable cash flows. (Wikipedia and financere.nrel.gov)

There are so many types of investors. Some of them only invest in IPO, some trade with big positions, and some may not be interested in taking a significant risk. It’s difficult for the risk aversion types to invest in Equity markets. Most of the time, they want a predictable return, not only return but Cash. That isn’t easy in Equity as most of the time. It would help if you sold the Share to receive the amount. So all because of that, Financial Engineering develop some investment vehicles. Yieldco is one of them. They are not new and famous in US markets.

The structure of Mutual Funds is excellent and easy to understand, so many First-time investors choose it. So you may find the same system with so many other investment vehicles. REIT, ETF, Infrastructure Investment Trust, and some others. Yieldco is also in the same group. The best thing about the Yieldco structure is Under this model, the investors get the annual returns as a dividend, and the capital remains invested for the long term. In this model, the cost of capital is lowered by separating volatile assets like development, research, and construction.

The model, which has already been gaining ground in the US and some other markets, is used in the renewable energy sector to protect investors against regulatory changes. American and European companies, through IPOs of YieldCos, are first spun off from their primary business and then get listed separately. As many investors know, the spinoff is one of the best ways to give a return. But, according to a USIBC report, there may be opportunities to explore the YieldCo dividend model specifically for Indian smart cities. So maybe it is time to invest in some essential study.